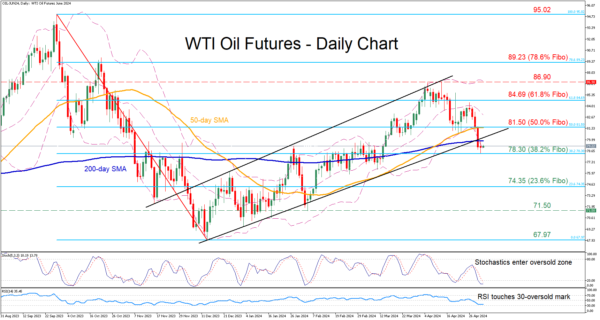

- WTI futures retreat below both 50 and 200-day SMAs

- Violate ascending channel in place since November

- Oscillators approach oversold conditions

WTI oil futures (June delivery) had been in a steady uptrend since December, posting a fresh six-month peak of 86.90 on April 12. However, the price has been undergoing a pullback since then, dropping beneath both its 50- and 200-day simple moving averages (SMAs) to a fresh one-month low on Thursday.

Should the decline resume, immediate support could be found at 78.30, which is the 38.2% Fibonacci retracement of the 95.02-67.97 downleg. Failing to halt there, the price may descend towards the 23.6% Fibo of 74.35. Even lower, the February bottom of 71.50 might prevent further retreats.

On the flipside, bullish actions could propel the price back above its 200-day SMA to challenge the 50.0% Fibo of 81.50, which overlaps with the 50-day SMA. Conquering this barricade, the bulls may attack the 61.8% Fibo of 84.69. A violation of that zone could pave the way for the recent six-month peak of 86.90.

In brief, WTI oil futures have been experiencing a strong pullback over the past three weeks, with the price falling to its lowest level since March 14. Therefore, a failure to reclaim the 200-day SMA might lead to an acceleration of the decline.