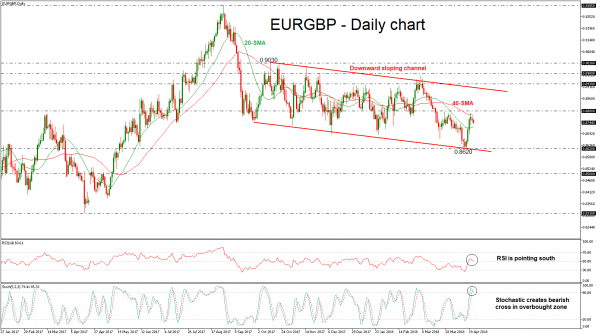

EURGBP accelerated sharply higher in the previous week but it has struggled to extend its gains over the last hours. The pair remains in a slightly downward-tilting channel, which has been in place since September 2017. The longer-term neutral to bearish outlook was recently confirmed again when the pair touched an 11-month low of 0.8620 on April 16.

In the near-term, the price failed to break the 40-day simple moving average (SMA) and is moving lower, as well as the technical indicators. The RSI indicator is pointing down and it has managed to cross into negative territory below the 50 level. Also, the stochastic oscillator has created a bearish crossover with the %K and %D line in the overbought zone, suggesting that the weakness in the market is not over yet.

In the near term, a downside push is possible with prices looking to post a second straight session of losses today. In case of a slip below the 20-day SMA, the price could touch the 0.8620 support barrier, which is holding near the lower boundary of the downward sloping channel. Further downside pressure could penetrate the channel to the downside and drive EURGBP towards the 0.8500 handle.

On the flip side, an immediate level is likely to come from the 0.8800 psychological level, which has proved a strong resistance area in the past. A break above that could lead prices near the upper channel line around the 0.8900 critical level.