BoC is widely expected to become the first major central bank to scale back monetary stimulus today. It would announce to its asset purchases to CAD3B/week, from CAD4B/week previously. Overnight rate will be held at effective lower bound of 0.25%. The central will also likely revise up its economic projections.

The main question is whether the more optimistic outlook would prompt a change in the forward guidance. BoC had indicated that the policy rate will stay unchanged “until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved”, and this would unlikely happen until 2023. A better economic outlook might lead the members to see slack be absorbed earlier than 2023.

Here are some previews:

- BOC Preview – Expects Upgrades on Economic Forecasts and More Optimistic Forward Guidance

- Bank of Canada Policy Meeting: A Bond Tapering Story

- Will a Bank of Canada Taper Lift CAD?

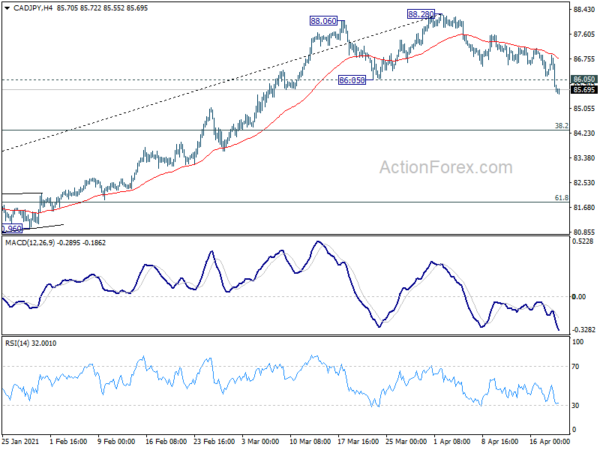

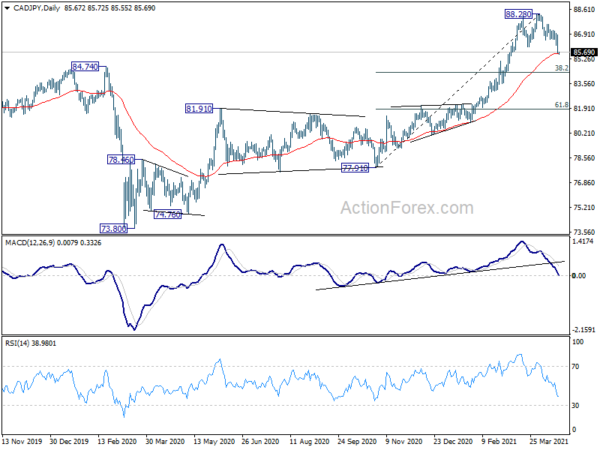

Canadian Dollar is currently the weakest one for the week, even worse than the greenback. Tapering of asset purchase was well priced in already. If there is no significant upgrade in the outlook, we’d expect CAD’s correction to continue. CAD/JPY’s break of 86.05 support overnight suggests that deeper correction in underway. Near term bearishness is also affirmed by rejection by 4 hour 55 EMA. We’d now expect deeper fall to 38.2% retracement of 77.91 to 88.28 at 84.31.