Two central banks will announce monetary policy decisions today. BoE is generally expected to deliver a back-to-back rate hike and raise Bank Rate by 25bps to 0.50%. The central bank would also reveal the approach to wind down the GBP 895B asset purchases. Looking ahead, more tightening is expected ahead to bring the Bank Rate to 1.00% level by the end of the year. That should be reflected in the new economic projections in the Monetary Policy Summary.

On the other hand, ECB is expected to stand pat and maintain a cautious tone even though inflation surged to another record in January. Markets are seeing the first rate hike, at 10bps, by July. But President Christine Lagarde would likely talk down such expectations.

Here are some previews on ECB and BoE:

- EU CPI Blows Away Estimates. Will it Affect ECB Decision?

- ECB Policy Meeting: Dovish Tune with Hawkish Beats

- ECB Meeting Preview: Don’t Expect a Hawkish Shift Yet!

- ECB Preview – Inflation Uncertainty and Data Dependency

- BoE Preview: Another Rate Hike and Passive QT

- BoE Preview: BoE Set for Two Consecutive Hikes?

- U.K.: Slower Growth, Faster Inflation, Gradual Tightening

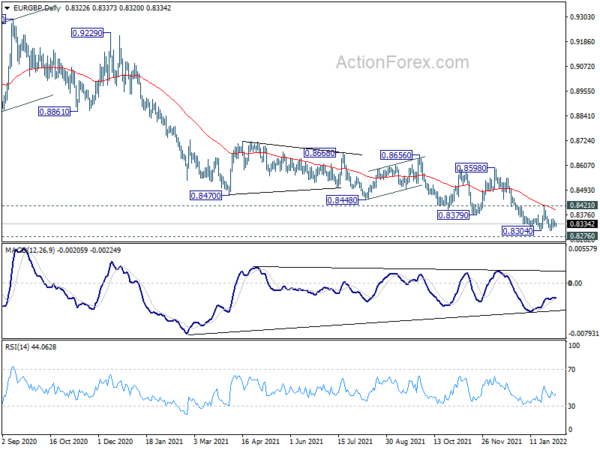

EUR/GBP is a pair to watch today. It should be noted that it’s now very close to a key long term support level at 0.8276, with bullish convergence condition in daily MACD. The conditions are there for a trend reversal. Break of 0.8421 resistance will complete a small double bottom pattern (0.8304, 0.8304), and bring stronger rebound. Further break of 0.8598 resistance should confirm medium term bottoming and turn outlook bullish.

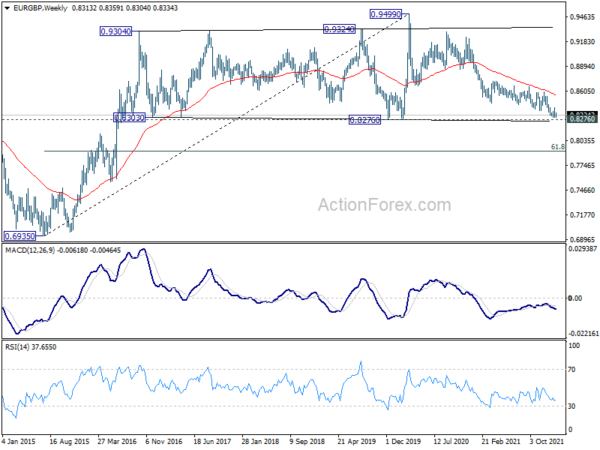

However, sustained break of 0.8276 would argue that fall from 0.9499 is developing into a long term down trend rather than a correction. Deeper decline would then be seen for the rest of the year towards 61.8% retracement of 0.6935 to 0.9499 at 0.7917, and possibly below.

EUR/GBP is now at a juncture.