A tremendous amount of uncertainty was added to ECB outlook from Russia’s invasion of Ukraine. There were expectations that ECB could announce an earlier end to its asset purchase program at today’s meeting, paving the way for a rate hike later this year. But now, it’s more likely for the central bank to keep options open for the moment.

Nevertheless, facing increasing risk of prolonged high inflation, hawks in the councils could push for at least a move to a “neutral” guidance. That could come in form of dropping the reference to a rate cut in the guidance. ECB might also remove the stipulation that rate hike would come “shortly” after end of net asset purchases.

The new economic projections would also be scrutinized while President Christine Lagarde would be asked for her views on risk of stagflation in Eurozone.

Here are some previews for today’s ECB meeting:

- ECB meeting: No right choices for the euro

- ECB Preview: A Tough Balancing Act Just Got Harder

- ECB Preview – Inflation Forces the Normalisation Process to Continue

Euro is staging a strong rebound since yesterday, while gold and oil prices are in deep retreat. The situation came as markets are exiting the phase of initial shock of Russia invasion. But clearly, the clouds are still there. Today’s ECB announce might give Euro some temporary volatility, but the next move will still very much depend on the development in Ukraine.

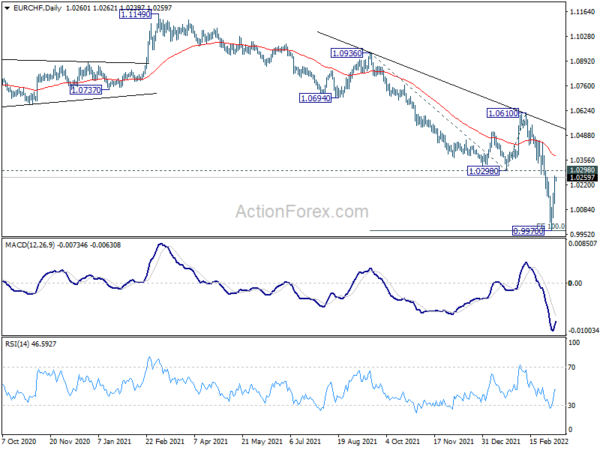

Technically, for EUR/CHF, 0.9970 is theoretically a good place to bottom. It’s not unreasonable to say that the down trend from 1.1149 has ended as a five-wave move, just hitting, 100% projection of 1.0936 to 1.0298 from 1.0610 at 0.9972. Parity can also provide additional psychological support. Yet, firm break of 1.0298 support turned resistance is still needed to be the first sign of major bottoming. Otherwise, risk will remain heavily on the downside.