ECB is widely expected to raise interest rates by 75bps today. After that, the main refinancing rate will be at 2.00%, and the once negative deposit rate will be at 1.50%. President Christine Lagarde would signal that more tightening lies ahead, but the decision will stick to a meeting-by-meeting approach, and be data dependent.

There might be discussions on quantitative tightening, but it’s still too soon to make a decision. The markets are expecting that concrete steps on shrinking the balance will only happen early next year.

Here are some previews on ECB:

- ECB Policy Meeting: Is More than a Rate Hike on the Table?

- ECB Preview: Everything You Need to Know

- What Can the ECB Do Now?

- ECB Preview – Focus on the Technicalities

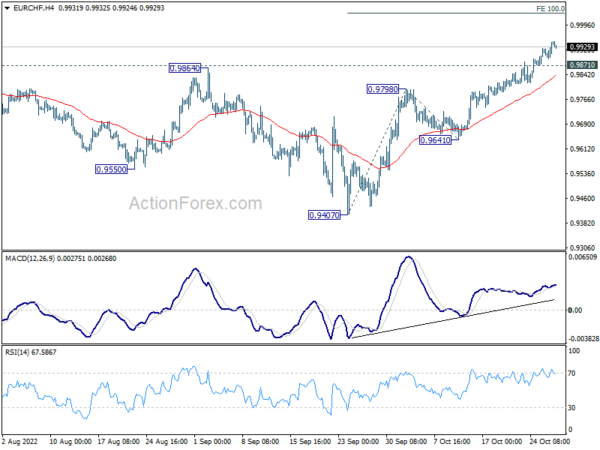

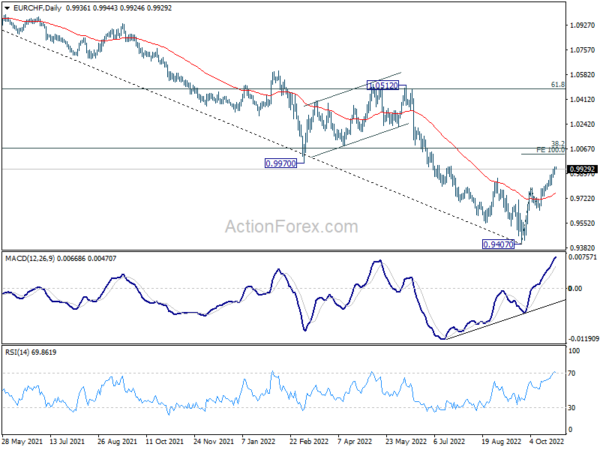

Regarding reaction to ECB decision, EUR/CHF is an interesting one to watch, as it’s now eyeing parity. The cross was in persistent decline from June to September, after SNB surprisingly acted on interest rate earlier than ECB. Back then, ECB was still adjusting their forward guidance that rate hike would come weeks after stopping asset purchases. Now that ECB is catching up with global tightening pace, there is more upside prospect in the crosses.

While upside momentum in EUR/CHF is not too convincing for the moment, further rise is expected as long as 0.9871 minor support holds. Next target is 100% projection of 0.9407 to 0.9798 from 0.9641 at 1.0032. It’s still too soon to judge whether rise from 0.9407 is a corrective bounce, or the start of an up trend. But in either case, stronger rally would be seen to 38.2% retracement of 1.1149 to 0.9407 at 1.0072. Reaction from there, as well as 55 week EMA (now at 1.0120) will reveal whether the trend is reversing.