US stocks closed significantly higher overnight, with DOW and S&P 500 extending their near-term rallies. This week’s data supported the view that disinflation is gaining momentum in the US, as evidenced by the notable downside surprise in US PPI and the below-expectation headline CPI readings for March. Additionally, jobless claims data indicated that job market remains stable rather than overheated. The overall picture suggests that while inflation is slowing, the economy isn’t crashing. These factors also contribute to the case that Fed’s tightening cycle is nearing its end, although it remains uncertain when Fed will reverse course.

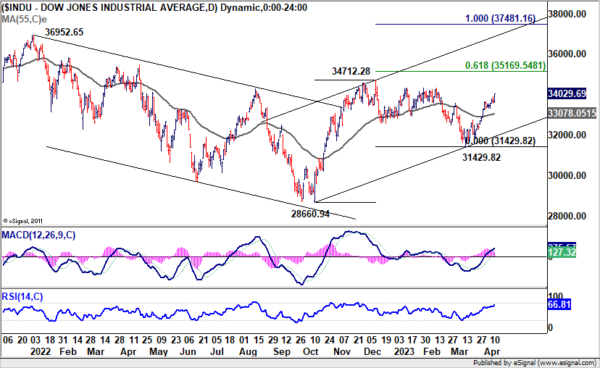

Technically, DOW’s corrective pattern from 34712.28 should have completed with three waves down to 31429.82. Further rise is now expected as long as 55 D EMA (now at 33078.05) holds. Break of 34712.28 resistance is envisaged as the rally continues. The test for the near term lies in 61.8% projection of 28660.94 to 34712.28 from 31429.82 at 35169.54. Decisive break there could add more fuel to the rally and prompt upside acceleration through. 36952.65 high later in the year.