Canadian Dollar is currently the second best performer of the week after yesterday’s surprised 25bps rate hike by BoC to 4.75%. Most economists see the move after a 2-meeting pause as a “restart” of the tightening cycle rather than a “one-off”. Another rate hike is now generally expected in July to bring interest rate to 5.00% level.

The biggest question is whether 5.00% is “sufficiently restrictive” enough to bring supply and demand back into balance and return inflation to 2% target. It’s a big unknown for the markets as well as BoC.

Technically, while Canadian Dollar is strong this week, tough resistance levels lie just ahead. The key level is 1.3224 cluster support, with 38.2% retracement of 1.2005 to 1.3976 at 1.3233. Price actions from 1.3976 could still be considered a sideway corrective pattern as long as 1.3224/33 holds. That is, larger up trend would remain intact.

However, firm break of 1.3299 support would risk downside acceleration to push USD/CAD through 1.3224/33 decisively. 100% projection of 1.3860 to 1.3299 from 1.3653 at 1.3092 would be the immediate target, with risk of even deeper decline in the medium term.

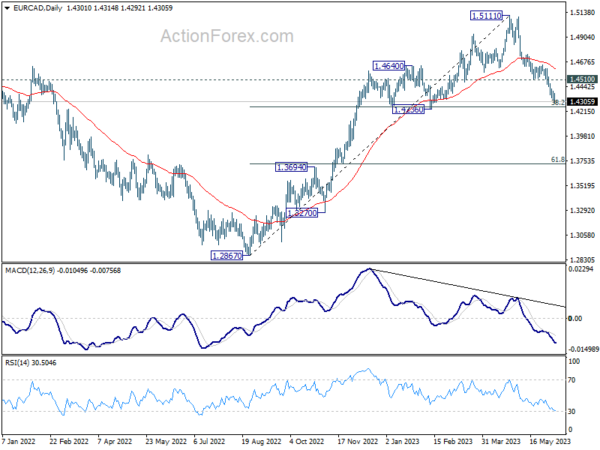

As for EUR/CAD, it’s now quickly approaching the key zone of 1.4236 cluster support (38.2% retracement of 1.2867 to 1.5111 at 1.4254). There is still prospect of a bounce from the zone. Break of 1.4510 minor resistance will suggest that the corrective fall from 1.5111 has completed and bring stronger rebound back to 55 D EMA (now at 1.4601) and above.

However, sustained decisive break of 1.236 could trigger further downside acceleration to 61.8% retracement at 1.3724, even just as a deep corrective move.