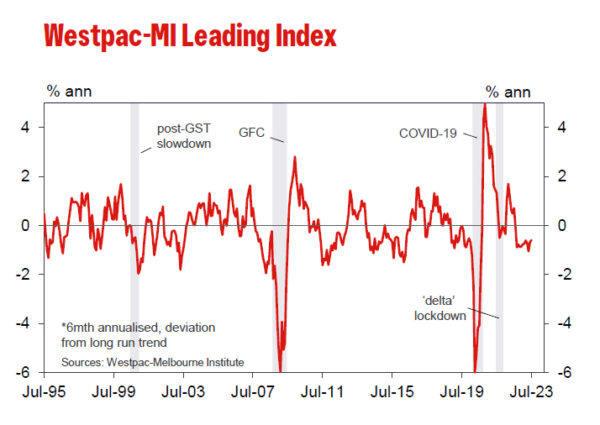

Australia’s Westpac Leading Index figures reveals that growth rate has shown a marginal uptick, moving from -0.67% to -0.60% in July. But alarmingly, this marks the twelfth consecutive month in red, representing the longest stretch of such negative prints in a span of seven years, barring the COVID-affected period.

The subdued, below-par growth momentum witnessed throughout 2023 seems set to persist into the subsequent year. Westpac predicts deceleration in GDP growth to a mere 1% for the current year. Any potential rebound is anticipated to be minimal, with projections indicating a slight rise to 1.4% annually in 2024 – with the bulk of this growth concentrated towards the year-end.

Regarding RBA meeting on September 5, Westpac sets its expectations clear. The institution foresees cash rate remaining stable at 4.10%, denoting the zenith of this current tightening phase.

Referring the recent remarks of RBA Governor before the House of Representatives Standing Committee on Economics, the note emphasized, “Policy is now in a ‘calibration’ phase with small adjustments still possible if the data starts to show clear risks of a slower return to low inflation.”

Nevertheless, given the evident frailty in growth momentum – as underscored by the most recent Leading Index update – coupled with the broader dynamics of price and wage inflation aligning with RBA’s forecasts, “the threshold for additional tightening is high and unlikely to be met.”