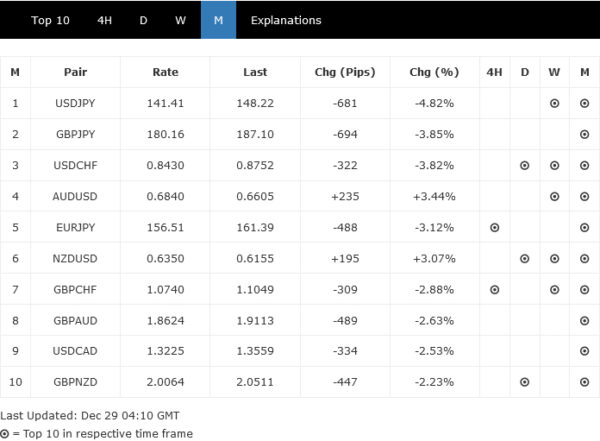

Japanese Yen is poised to be December’s best performer in the currency markets. Its strength is primarily driven by growing expectations that BoJ will eventually exit its long-standing negative interest rate policy in 2024. Yen’s performance is particularly noteworthy against Dollar (USD/JPY) and Sterling (GBP/JPY), both of which are top movers for the month, with the possibility of ending down more than 700 pips.

The strengthening of Yen comes amidst a broader context where other major global central banks, such as Fed, ECB, and BoE, are expected to start loosening their monetary policies or, in some cases like SNB, BoC and RBNZ, maintain unchanged rates.

BoJ Governor Kazuo Ueda has recently softened his typically dovish tone, acknowledging that the likelihood of a rate hike in 2024 is “not zero.” He also emphasized the importance of the Spring wage negotiations and the need for wage hikes to “broaden” from large companies to small businesses. This change in stance has contributed further to Yen’s rally, with April being viewed as a probable timing for rate hike. Yen could see further gains if incoming information in Q1 solidifies this expectation.

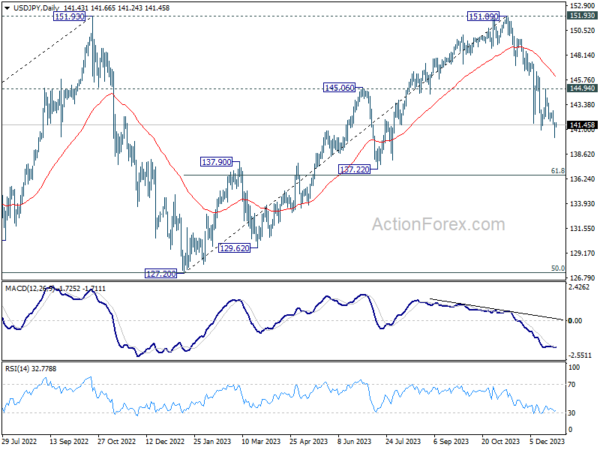

Technically, USD/JPY’s fall from 151.89 is seen as the third leg of the consolidation pattern from 151.93. Further decline is expected as long as 144.94 resistance holds. Next target is 61.8% retracement of 127.20 to 151.89 at 136.63, sustained break there will pave the way to 127.20 support (2022 low).

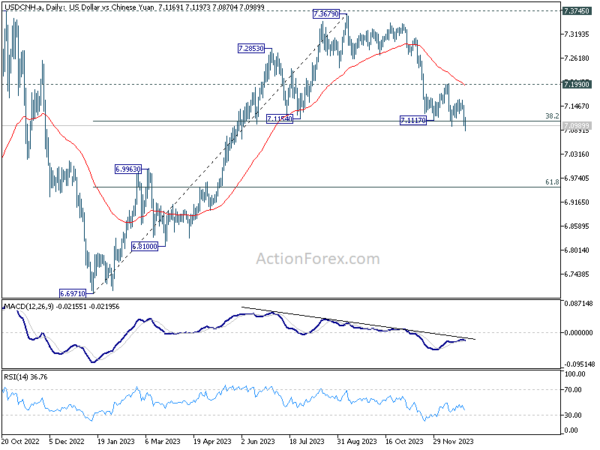

At the same time, USD/CNH is undergoing similar development. The pair is having a second attempt to break through 38.2% retracement of 6.6971 to 7.3679 at 7.1117. Sustained trading below this level will strengthen the case that fall from 7.3679 is the third leg of the consolidation pattern from 7.3745, aligning with the outlook of USD/JPY. In this case, deeper fall would be seen to 61.8% retracement at 6.9533, with prospect of having a take on 6.6971 support.