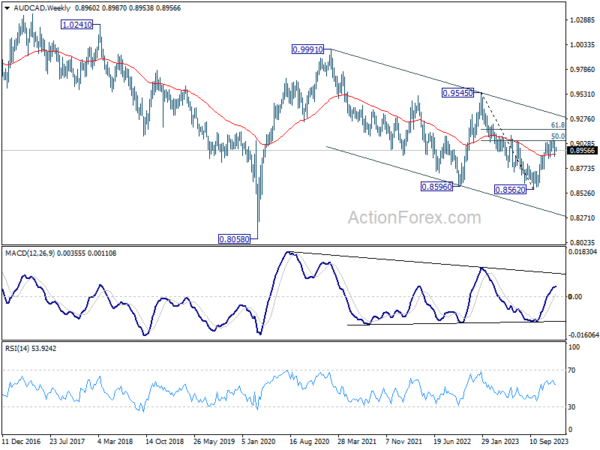

The recovery of AUD/CAD since last September has been largely attributed to the divergence in monetary policies between RBA and BoC. While RBA extended its tightening cycle, BoC’s interest rate reached a plateau. The rally in December was particularly driven by speculations of an additional RBA rate hike, although the momentum lost steam after briefly surpassing 0.9 handle.

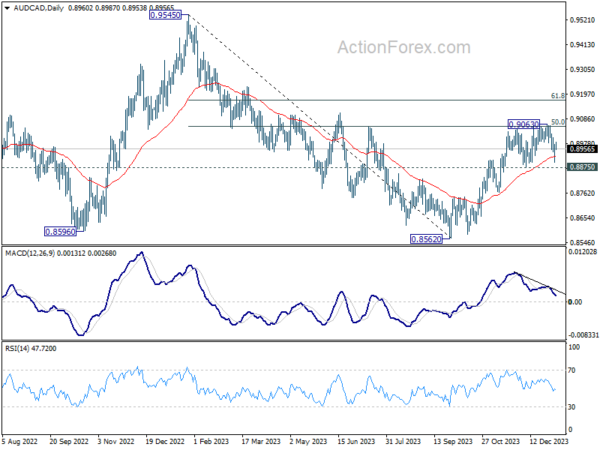

Technically speaking, this recovery from 0.8562 is more corrective looking than impulsive. The notable decline since the start of the year indicates that a short term top was already formed at 0.9063, on bearish divergence condition in D MACD. Break of 0.8875 support should also confirm rejection by 50% retracement of 0.9545 to 0.8562 at 0.9054. That would turn near term outlook bearish for retest 0.8562 low.

The upcoming release of Australia’s monthly CPI data could serve as a catalyst for a downturn in AUD/CAD. However, the sustainability of downside momentum, especially in breaking through 0.8562 support, will very much depend on which central bank between RBA and BoC starts cutting interest rates first and the subsequent policy paths they adopt.