Sterling has shown marked strength this week, with upcoming UK January inflation data eagerly awaited as potential catalyst for further gains. CPI is expected to edge up from 4.0% yoy to 4.1% yoy, continuing its rebound from the low of 3.9% set in November. Core CPI is also expected to rise from 5.1% yoy to 5.2% yoy.

Some analysts suggest that these projected upticks may stem largely from base effects, yet the focal point remains on the path of services inflation, which has shown a gradual increase in recent months, from December’s 6.4%, and November’s 6.3%.

Should the inflation data come in slightly above expectations, it is unlikely to shift the majority of BoE MPC towards advocating for further rate hikes alongside members like Jonathan Haskel and Catherine Mann. However, persistent stickiness in inflation, especially within the services sector, would prompt BoE to delay any rate reductions further.

The market’s reaction to this week’s robust job and wage figures has shifted expectations for BoE’s initial rate reduction to August. Today’s CPI data, coupled with tomorrow’s GDP figures, could further influence these projections.

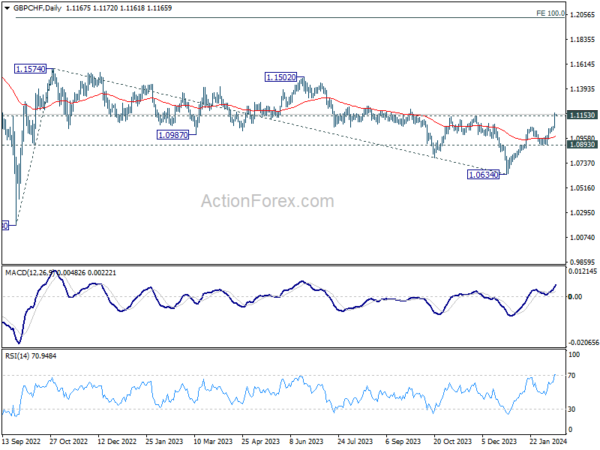

GBP/CHF’s rally accelerated higher this week. Sustained trading above 1.1153 resistance and 55 W EMA (now at 1.1149) will strengthen the case that whole correction from 1.1574 has completed with three waves down to 1.0634. Rise from 1.0634 would then develop into a medium term rally, resuming the rebound from 1.0183 (2022 low), and target 100% projection of 1.018 to 1.1574 from 1.0634 at 1.2025.

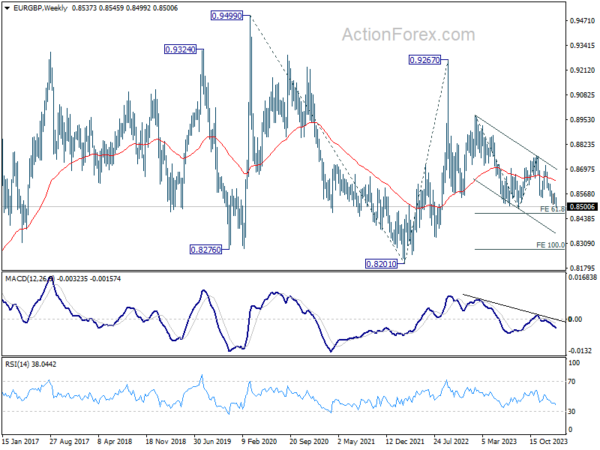

At the same time, EUR/GBP’s down trend resumed and it’s now on track to 61.8% projection of 0.8977 to 0.8491 from 0.8764 at 0.8464. Decisive break there could prompt downside acceleration, as fall from 0.9267 (2022 high) extends, and target 100% projection at 0.8278.