Nikkei index surged to new record today, signaling robust appetite for risk among Japanese investors, while Yen faces downward pressure, in particular against European majors. Consumer inflation data is in the spotlight in the upcoming Asian session.

Core CPI, which excludes food prices, is forecasted to decelerate from 2.3% to 1.8% in January, below BoJ’s 2% target for the first time in nearly two years. However, for the BoJ, the crucial figure lies in the core-core CPI (excluding both food and energy), which is awaited to see if it will decelerate from December’s 3.7%.

Governor Kazuo Ueda has consistently highlighted the significance of the outcomes from this year’s annual wage negotiations as a pivotal factor in determining the timeline for phasing out the negative interest rate policy.

With large businesses scheduled to conclude wage talks with unions on March 13, just days before BoJ’s next meeting on March 18-19, March is seen by some as a candidate for a rate hike. Yet, April, with the availability of new economic projections, remains a more plausible window for such policy adjustments.

However, any unexpected strength in the inflation report could fuel speculation about an earlier rate hike.

USD/JPY has been losing much momentum after breaking 150 handle. Threat of intervention by Japan could be a major factor keeping USD/JPY bulls from aggressive buying. Nevertheless, rally from 140.25 is still in tact as long as 148.79 support holds. But the path to 151.89/93 resistance zone would be slow.

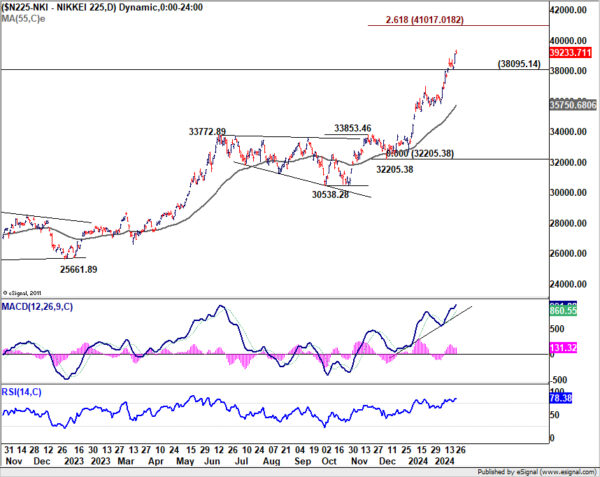

As for Nikkei, it should be rather undeterred by the inflation data. Near term outlook will stay bullish as long as 38095.14 support holds. Next target is 40k psychological level, or even further to 261.8% projection of 30538.28 to 33853.46 from 32205.38 at 41017.01.