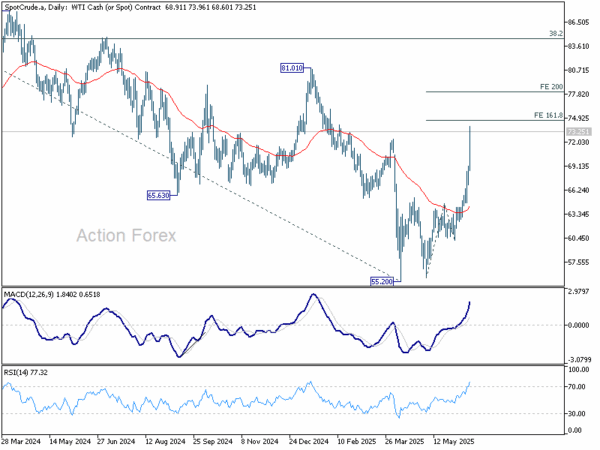

Crude oil prices surged sharply following news that Israel had launched direct airstrikes against Iran, targeting its nuclear and ballistic missile infrastructure. WTI crude is now trading more than 30% above its April low of 55.20, as geopolitical tensions in the Middle East reignite supply risk concerns.

Israeli Prime Minister Benjamin Netanyahu confirmed that the military had struck Iran’s Natanz enrichment site, leading nuclear scientists, and the core of its missile program, vowing to continue operations “for as many days as it takes to remove this threat.”

The military action was carried out without coordination with Washington. US Secretary of State Marco Rubio emphasized that Israel acted unilaterally and that the US was not involved in the strikes.

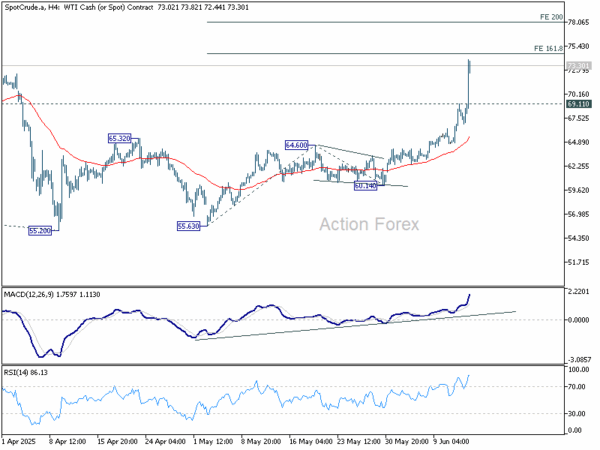

Technically, despite the sharp rally in WTI oil, strong resistance is expected between 74.65 and 78.08 to limit upside 161.8% projection of 55.63 to 64.60 from 60.14. at 74.65 and 200% projection at 78.08), on overbought condition. Break of 69.11 resistance turned support would indicate that the current buying wave has likely peaked.

Still, the path forward depends heavily on how geopolitical events unfold. Should the conflict escalate further or draw in regional actors, a break above the resistance zone could open the door to a test of 81.01, a level that marks the potential start of a broader bullish reversal in the longer-term oil trend.