As seen in the D heat map, CAD is the strongest one today while JPY is the weakest one.

A look at the top mover chart also sees CADJPY as the biggest mover. It’s natural to have a look at how CADJPY is performing.

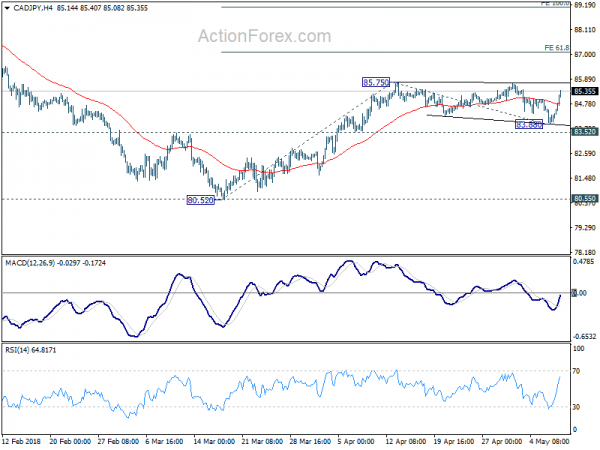

In CADJPY action bias table, H action bias momentum is very apparent, not so in the 6H row.

But the 6H action bias chart clearly shows that CAD/JPY was in a consolidation pattern since hitting 85.75 back in April. And the strong H action bias momentum suggests that it’s possibly completed at 83.88 earlier this week. A long trade in CADJPY should be in place for position trading.

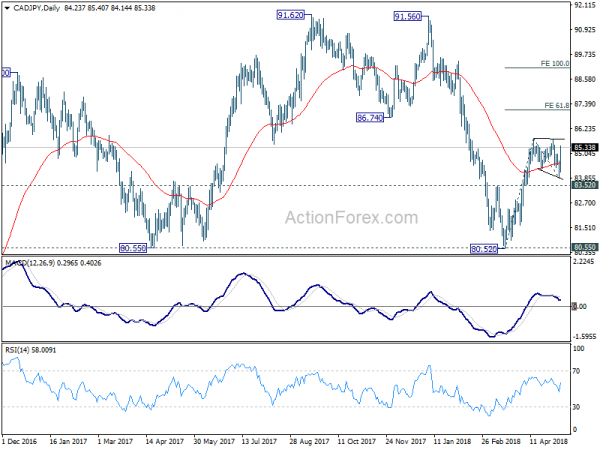

And, recalling a short note here, CAD/JPY formed a bottom at 80.52 in March, after drawing support from 80.55 key support. Rise from 80.52 is seen as at the same degree as fall from 91.56 to 80.52. Pull back from 85.75 was contained above mentioned 83.52 support and thus maintained bullishness.

Hence, for a long trade, one could buy at a dip or break of 85.75 resistance. First target is 61.8% projection of 80.52 to 85.75 from 83.88 at 87.11. Second target is 100% projection at 89.11.