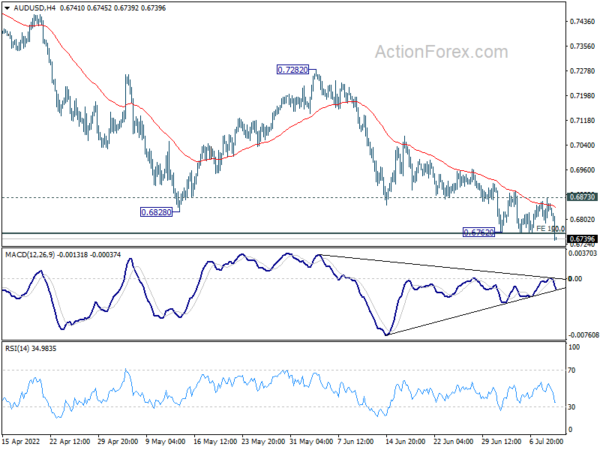

Daily Pivots: (S1) 0.6809; (P) 0.6842; (R1) 0.6891; More…

AUD/USD’s down trend resumes by breaking through 0.6762 temporary low and intraday bias is back on the downside. Sustained trading below 0.6756/60 will carry larger bearish implication. Next target will be 0.6461 fibonacci level. On the upside, though, break of 0.6873 resistance will indicate short term bottoming, and turn bias back to the upside for stronger rebound.

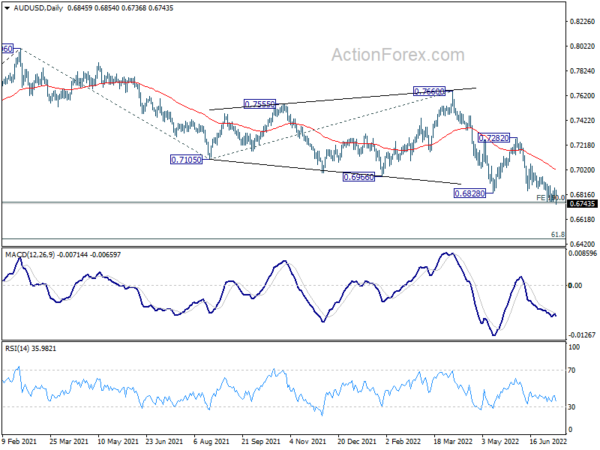

In the bigger picture, price actions from 0.8006 could still be a corrective pattern to rise from 0.5506 (2020 low). But current downside acceleration is raising the chance that it’s a bearish impulsive move. Sustained trading below 0.6756/60 ( 50% retracement of 0.5506 to 0.8006 at 0.6756, 100% projection of 0.8006 to 0.7105 from 0.7660 at 0.6760), will pave the way to 61.8% retracement at 0.6461). For now, outlook will remain bearish as long as 0.7282 resistance holds, even in case of strong rebound.