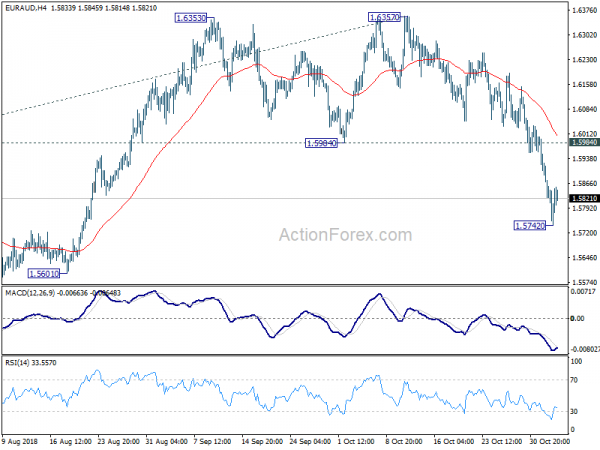

EUR/AUD’s sharp decline and firm break of 1.5984 support last week is taken as an early sign of medium term trend reversal. But with a temporary low in place at 1.5742, initial bias is neutral this week first. Some consolidation could be seen but upside should be limited by 1.5984 support turned resistance to bring another decline. Below 1.5742 will turn bias back to the downside for 1.5601 support. Break there will pave the way to 1.5271/5313 cluster support zone next.

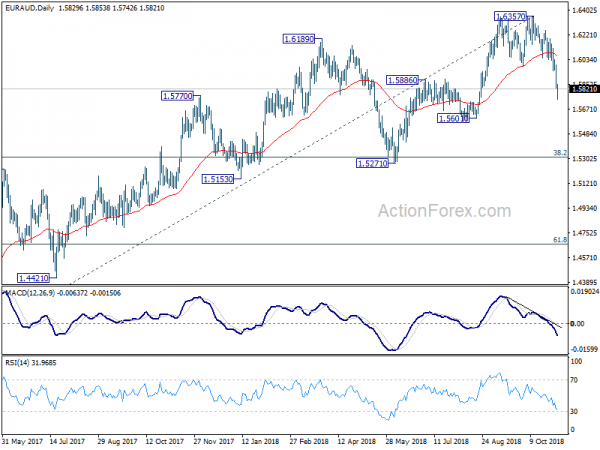

In the bigger picture, current development argues that up trend from 1.3624 (2017 low) is possibly completed at 1.6357, ahead of 1.6587 (2015 high). This is supported by bearish divergence condition in weekly MACD. Deeper decline is now in favor to 1.5271 cluster support (38.2% retracement of 1.3624 to 1.6357 at 1.5313). Break will target 61.8% retracement at 1.4668. On the upside, break of 1.6357 is needed to confirm up trend resumption. Otherwise, risk will now stay on the downside even in case of strong rebound.

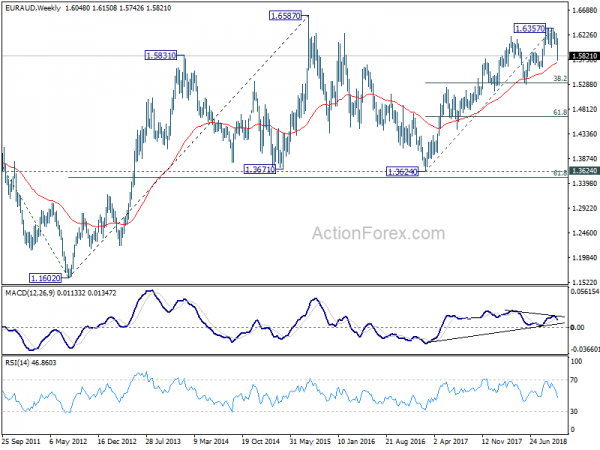

In the longer term picture, the rise from 1.1602 long term bottom (2012 low) isn’t over yet. We’ll keep monitoring the development but there is prospect of extending the rise to 61.8% retracement of 2.1127 to 1.1602 at 1.7488 and above. However, sustained trading below 1.3624 key support should indicate long term reversal and target 1.1602 long term bottom again.