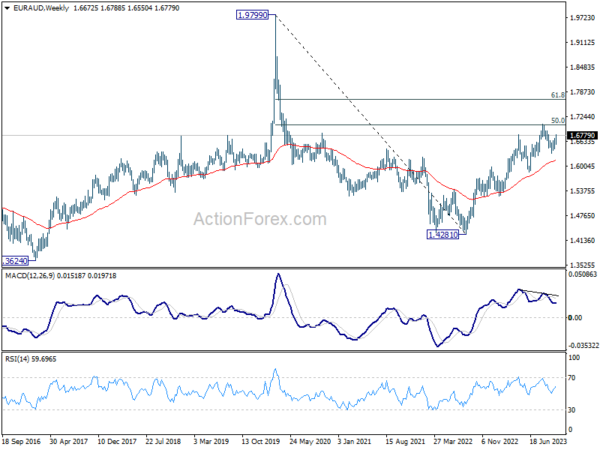

EUR/AUD’s rise from 1.6319 continued last week and outlook is unchanged. Initial bias remains on the upside this week for retesting 1.7062 resistance. Decisive break there will confirm larger up trend resumption. Next target is 100% projection of 1.5846 to 1.7062 from 1.6319 at 1.7353. On the downside, break of 1.6550 support is needed to indicate completion of the rebound. Otherwise, near term outlook will stay mildly bullish even in case of retreat.

In the bigger picture, the strong support from medium term rising trend line indicates that rise from 1.4281 (2022 low) is still in progress. Sustained break of 1.7062 will pave the way to 61.8% retracement of 1.9799 (2020 high) to 1.4281 at 1.7691. In any case, outlook will stay bullish as long as 1.6319 support holds.

In the longer term picture, loss of upside momentum as seen in 55 W MACD at this stage argues that rise from 1.4281 (2022 low) is more likely a corrective move. Further rise could still be seen as long as 1.5846 support holds. But upside will likely be limited by 61.8% retracement of 1.9799 to 1.4281 at 1.7691. Firm break of 1.5846 support will argue that the rise has completed, and another medium term down leg has started.