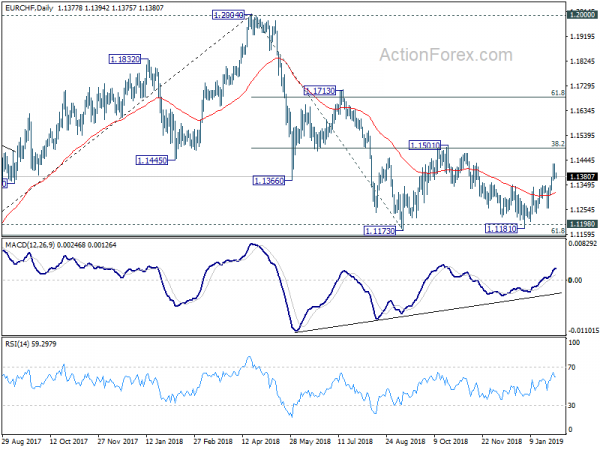

Daily Pivots: (S1) 1.1361; (P) 1.1395; (R1) 1.1417; More…

Intraday bias in EUR/CHF is turned neutral with the current retreat and some consolidations could be seen. But further rise is expected as long as 1.1347 resistance turned support holds. On the upside, break of 1.1429 will resume the rise from 1.1181 to 1.1501 key resistance. However, break of 1.1347 will argue that such rebound might be finished. Intraday bias will then be turned back to the downside for 1.1259 support instead.

In the bigger picture, price actions from 1.2004 medium term top is seen as a correction only. Downside should be contained by support zone of 1.1198 (2016 high) and 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to complete it and bring rebound. A break of 1.2 key resistance is still expected in the medium term long term. However, sustained break of the mentioned support zone will mark reversal of the long term trend. In that case, 1.0629 key support will be back into focus.