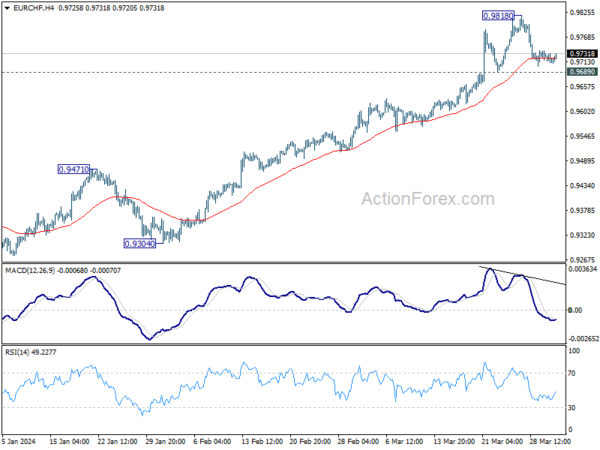

Daily Pivots: (S1) 0.9705; (P) 0.9721; (R1) 0.9729; More…

Intraday bias in EUR/CHF remains neutral as consolidation continues below 0.9818. Another rally is expected as long 0.9689 support holds. On the upside, above 0.9818 will resume the rise from 0.9252 towards 1.0095 key resistance next. Nevertheless, considering bearish divergence condition in 4H MACD, break of 0.9689 will indicate short term topping, and turn bias back to the downside for 55 D EMA (now at 0.9581) instead.

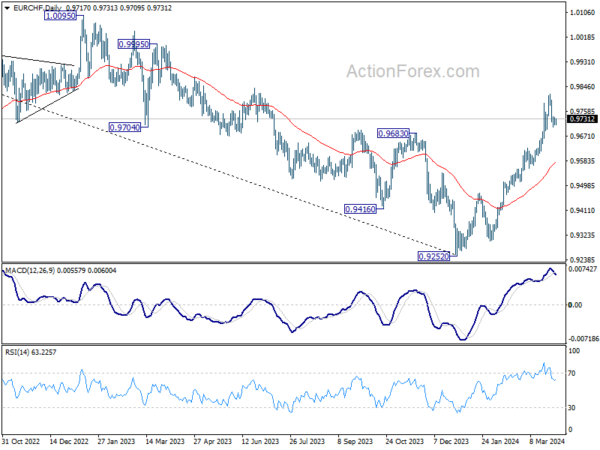

In the bigger picture, a medium term bottom should be in place at 0.9252 already, on bullish convergence condition in W MACD. Rise from there would now target 38.2% retracement of 1.2004 (2018 high) to 0.9252 (2023 low) at 1.0303, even as a correction to the down trend from 1.2004. This will remain the favored case as long as 55 D EMA (now at 0.9576) holds.