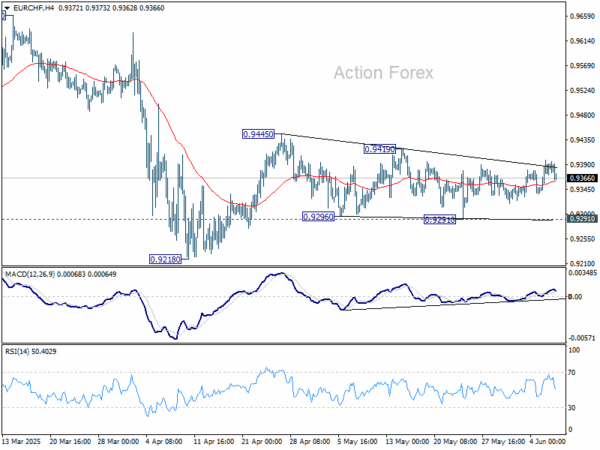

EUR/CHF rebounded last week mildly last week, but failed well ahead of 0.9419 resistance and retreated. Initial bias remains neutral this week first. Price actions from 0.9445 are seen as a triangle consolidation pattern, and thus rise from 0.9218 is not finished. Break of 0.9419 will argue that the rise, either as a correction to fall from 0.9660, or the third leg of the pattern from 0.9204, is ready to resume through 0.9445. Nevertheless, on the downside, firm break of 0.9291 will bring retest of 0.9218 low.

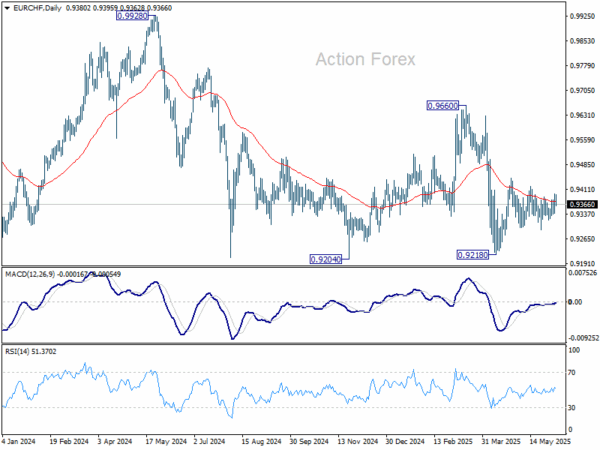

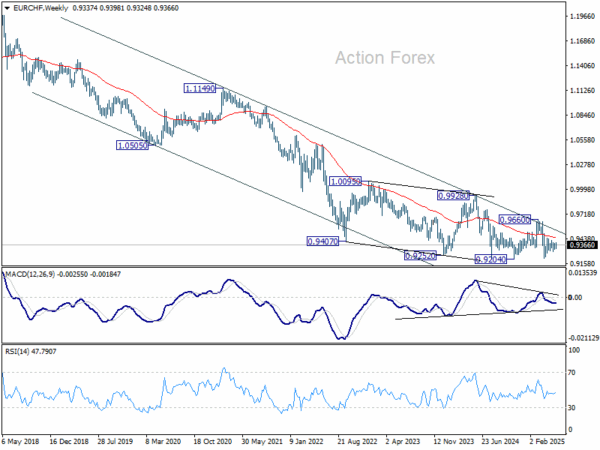

In the bigger picture, prior rejection by long-term falling channel resistance (now at 0.9527) retains medium term bearishness. That is, down trend from 1.2004 (2018 high) is still in progress. Firm break of 0.9204 (2024 low) will confirm resumption. This will remain the favored case as long as 0.9660 resistance holds.

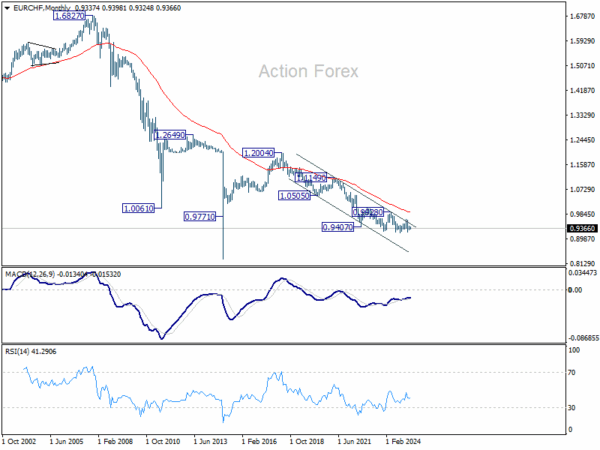

In the long term picture, overall long term down trend is still in force in EUR/CHF. Outlook will continue to stay bearish as long as 55 M EMA (now at 0.9919) holds.