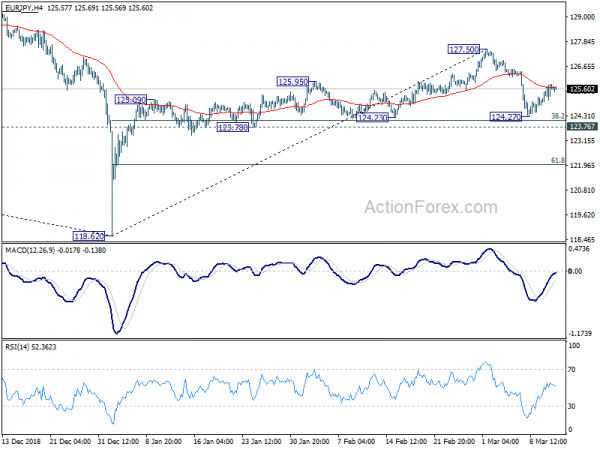

Daily Pivots: (S1) 125.18; (P) 125.51; (R1) 126.00; More….

Intraday bias in EUR/JPY remains mildly on the upside for the moment. Pull back from 127.50 could have completed at 124.27. With 124.23 cluster support (38.2% retracement of 118.62 to 127.50 at 124.10) intact, rise from 118.61 is in favor to extend. On the upside, break of 127.50 will target 129.50 resistance next. On the downside, however, decisive break of 124.10/23 should confirm completion of whole rebound from 118.61. Deeper fall should at least be seen to 61.8% retracement at 122.01 and below. In this case, the chance of resuming larger down trend will also increase.

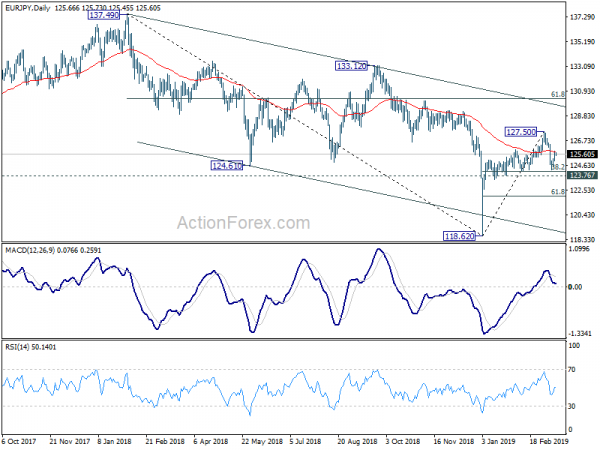

In the bigger picture, current development argues that medium term decline from 137.49 (2018 high) has completed with three waves down to 118.62 already. Decisive break of 133.12 resistance will confirm this bullish case. And whole up trend from 109.03 (2016 low) might resume through 137.49 in that case. On the downside, break of 124.23 support will invalidate this case. And in such case, the down trend from 137.49 could possibly resume through 118.62.