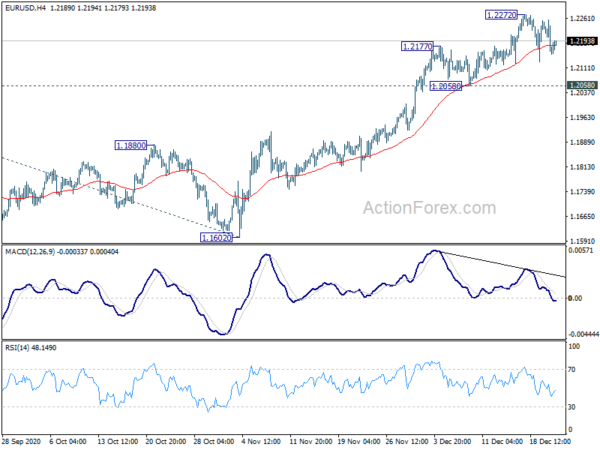

Daily Pivots: (S1) 1.2126; (P) 1.2191; (R1) 1.2231; More….

Intraday bias in EUR/USD remains neutral for the moment as consolidation from 1.2272 is extending. Considering bearish divergence condition in 4 hour MACD, break of 1.2058 will confirm short term topping. Intraday bias will be turned to the downside for deeper pull back to 55 day EMA (now at 1.1956). On the upside, though, firm break of 1.2272 will resume larger rally to 61.8% projection of 1.0635 to 1.2011 from 1.1602 at 1.2452 next.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.