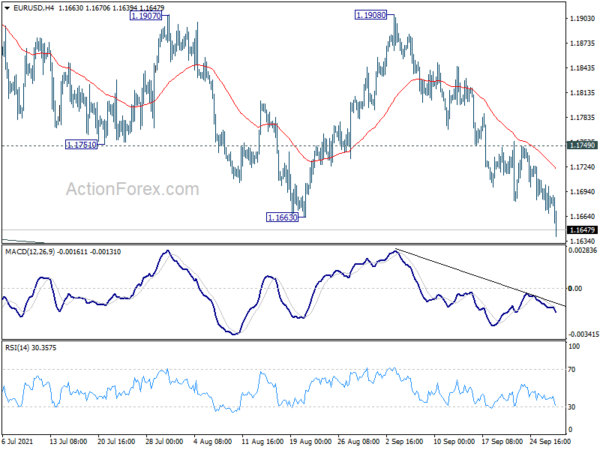

Daily Pivots: (S1) 1.1667; (P) 1.1685; (R1) 1.1702; More…

EUR/USD’s break of 1.1663 support indicates resumption of fall from 1.2265, which is seen as the third leg of the pattern from 1.2348. Intraday bias is back on the downside for 1.1602 key support level next. Sustained break there will argue that it’s at least on larger scale correction. Next target would be 1.1289 medium term fibonacci level. On the upside, break of 1.1749 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally remains in favors long as 1.1602 support holds, to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289 and below.