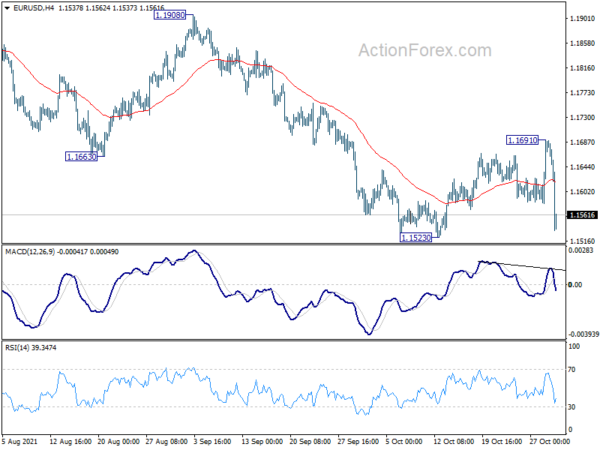

EUR/USD rebounded to 1.1691 last week, but was rejected by 55 day EMA and fell sharply from there. It’s also kept inside near term falling channel. Thus outlook in the pair stays bearish. Initial bias is now on the downside this week for 1.1523 support. Break there will resume the fall from 1.2265, and that from 1.2348 too, for long term fibonacci level at 1.1289 next. For now, further decline is expected as long as 1.1691 resistance holds, in case of recovery.

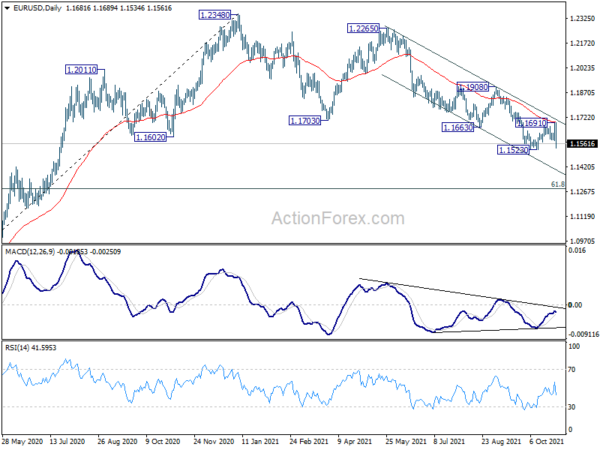

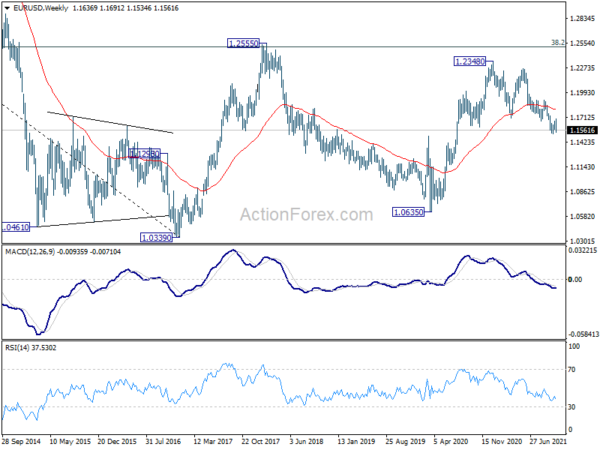

In the bigger picture, price actions from 1.2348 should at least be a correction to rise from 1.0635 (2020 low). As long as 1.1908 resistance holds, deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289. Nevertheless break of 1.1908 resistance will revive medium term bullishness and turn focus back to 1.2348 high.

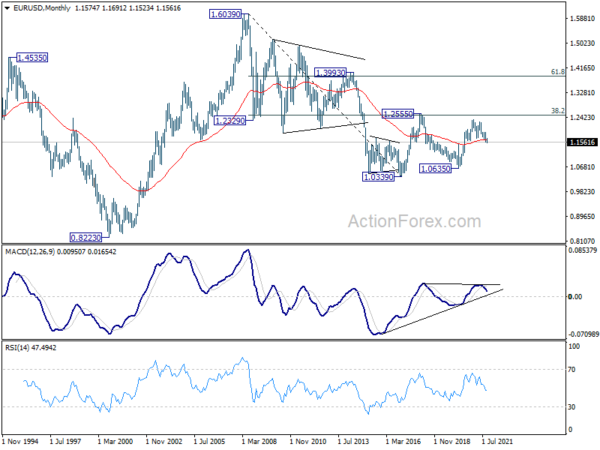

In the long term picture, EUR/USD has possibly failed 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516) already. Long term outlook will remain neutral as sideway pattern from 1.0339 (2017 low) is extending with another medium term fall. For now, we’d hold back from assessing the chance of downside breakout, and monitor the momentum of the decline from 1.2348 first.