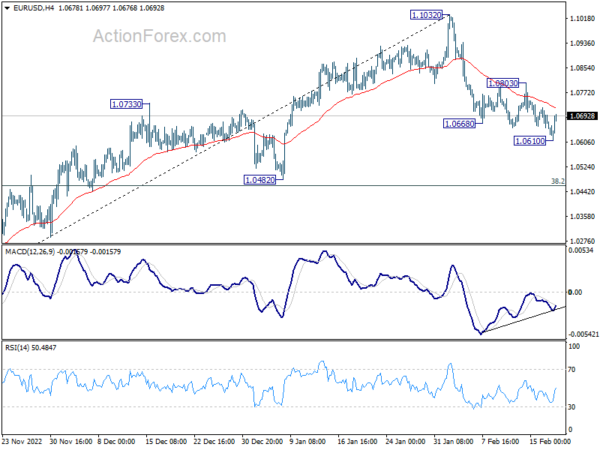

EUR/USD’s decline from 1.1032 resumed last week and dipped to 1.0610. But subsequent recovery indicates that a temporary low was formed. Initial bias is turned neutral this week first. Risk will stay on the downside as long as 1.0803 resistance holds. Below 1.0610 will target 38.2% retracement of 0.9534 to 1.1032 at 1.0463. Strong support should be seen around there to bring rebound, at least on first attempt.

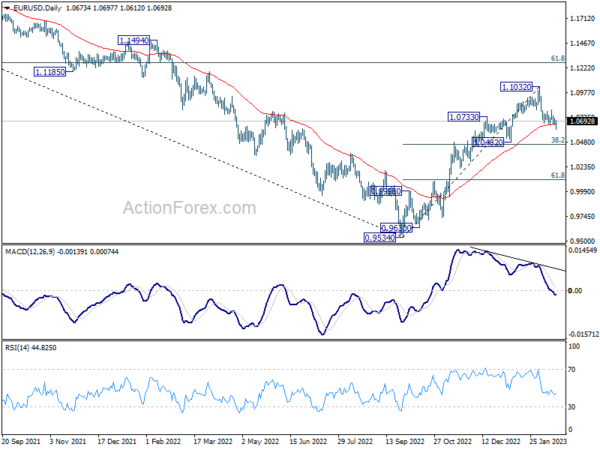

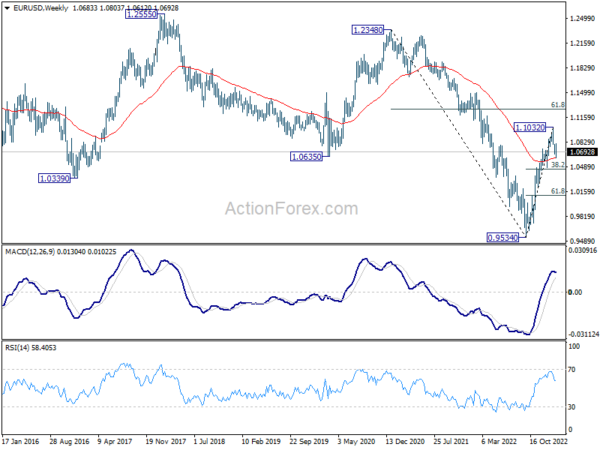

In the bigger picture, the rally from 0.9534 low (2022 low) is a medium term up trend rather than a correction. Further rise is in favor to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 next. This will remain the favored case as long as 1.0482 support holds.

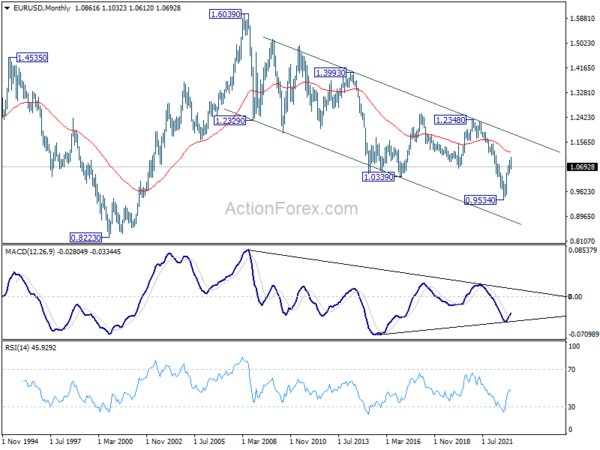

In the long term picture, while it’s too early to call for long term trend reversal at this point, the strong break of 1.0635 support turned resistance (2020 low) should at least turn outlook neutral. Focus will turn to 55 month EMA (now at 1.1189). Rejection by this EMA will revive long term bearishness.