Daily Pivots: (S1) 1.1747; (P) 1.1788 (R1) 1.1820; More….

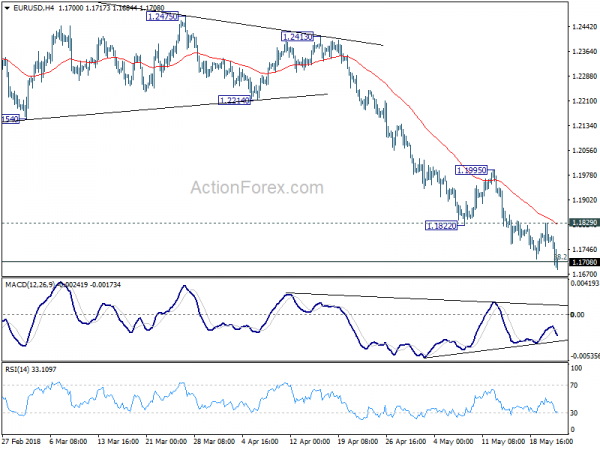

EUR/USD’s decline resumed after brief recovery and breaks 38.2% retracement of 1.0339 to 1.2555 at 1.1708. Intraday bias is back on the downside. Whole decline from 1.2555 should target 50% retracement at 1.1447 next. Though, considering bullish convergence condition in 4 hour MACD, break of 1.1829 minor resistance will suggest short term bottoming. And, lengthier consolidation would be seen in this year, before staging another fall.

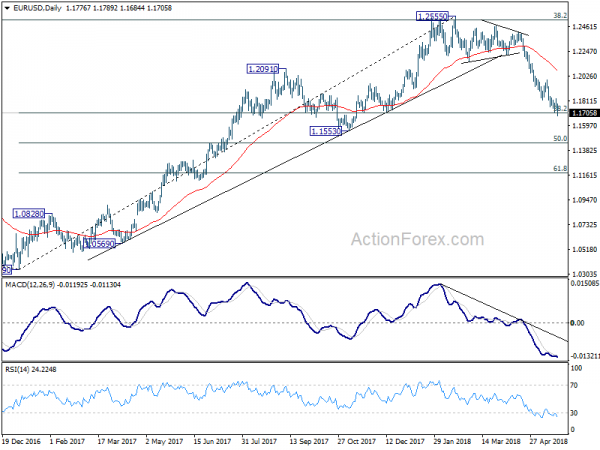

In the bigger picture, current development suggests that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further. Break of 38.2% retracement of 1.0339 to 1.2555 at 1.1708 will pave the way to 61.8% retracement at 1.1186. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 55 day EMA (now at 1.2076) holds.