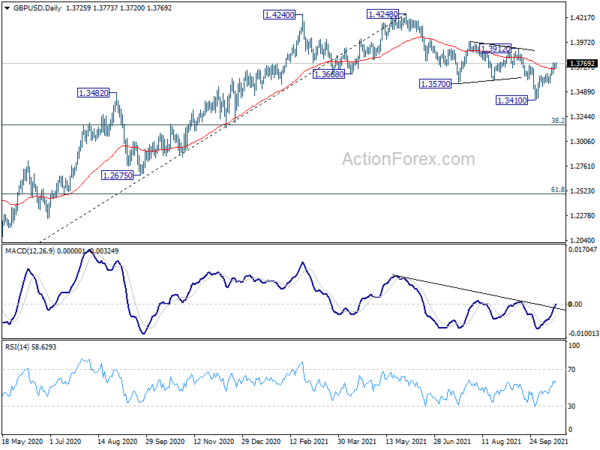

Daily Pivots: (S1) 1.3703; (P) 1.3734; (R1) 1.3759; More…

Intraday bias in GBP/USD stays on the upside as rise from 1.3410 is still in progress, for 1.3912 key structural resistance. Firm break there will indicate that the correction from 1.4248 is complete with three waves down to 1.3410. Further rally would then be seen to retest 1.4248 high. On the downside, however, break of 1.3567 support will turn bias back to the downside for 1.3410 low instead.

In the bigger picture, the structure of the fall from 1.4248 suggests that it’s a correction to the up trend from 1.1409 (2020 low) only. While deeper fall cannot be ruled out yet, downside should be contained by 38.2% retracement of 1.1409 to 1.4248 at 1.3164, at least on first attempt, to bring rebound. On the upside, firm break of 1.4376 key resistance (2018 high) will add to the case of long term bullish reversal. However, sustained trading below 1.3164 will revive some medium term bearishness and target 61.8% retracement at 1.2493.