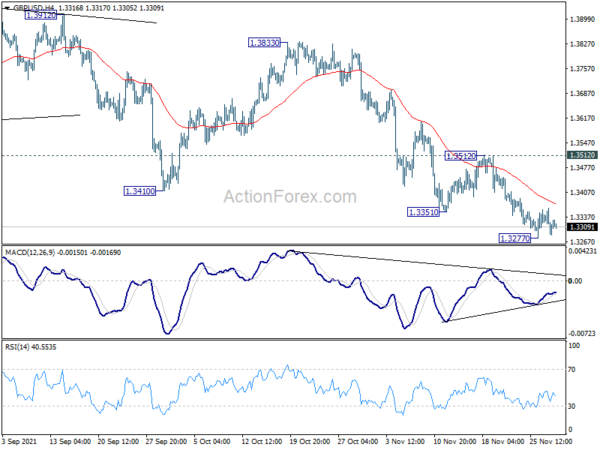

Daily Pivots: (S1) 1.3282; (P) 1.3323; (R1) 1.3357; More…

Intraday bias in GBP/USD remains neutral as consolidation from 1.3277 might extend. Upside of recovery should be limited below 1.3512 resistance to bring another fall. On the downside, break of 1.3277 will resume the decline from 1.4248 to 1.3164 fibonacci level next. Nevertheless, break of 1.3512 will indicate short term bottoming and bring stronger rebound.

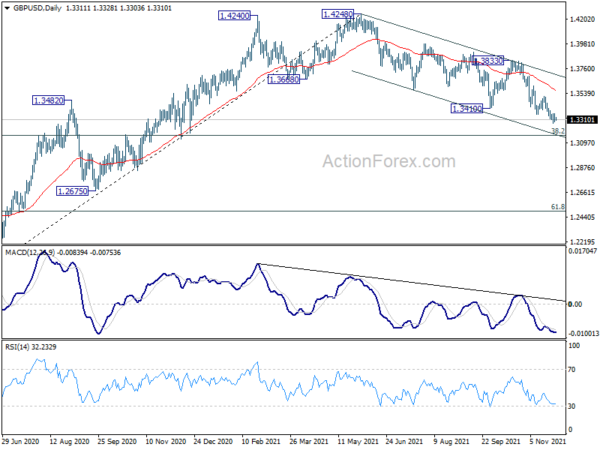

In the bigger picture, the structure of the fall from 1.4248 suggests that it’s a correction to the up trend from 1.1409 (2020 low) only. While deeper fall cannot be ruled out yet, downside should be contained by 38.2% retracement of 1.1409 to 1.4248 at 1.3164, at least on first attempt, to bring rebound. On the upside, break of 1.3833 resistance will argue that the correction has completed and bring retest of 1.4248 high. However, sustained trading below 1.3164 will revive some medium term bearishness and target 61.8% retracement at 1.2493.