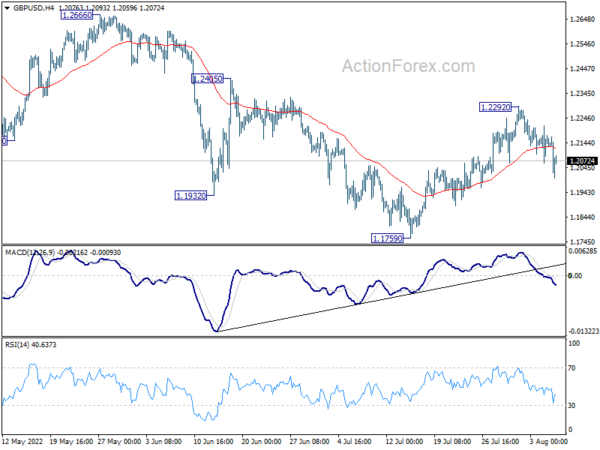

Despite edging higher to 1.2292 last week, subsequent fall in GBP/USD suggests that rebound from 1.1759 has completed, after hitting 55 day EMA. Initial bias is mildly on the downside for retesting 1.1759 low. On the upside, break of 1.2292 will resume the rebound towards 1.2405 resistance instead.

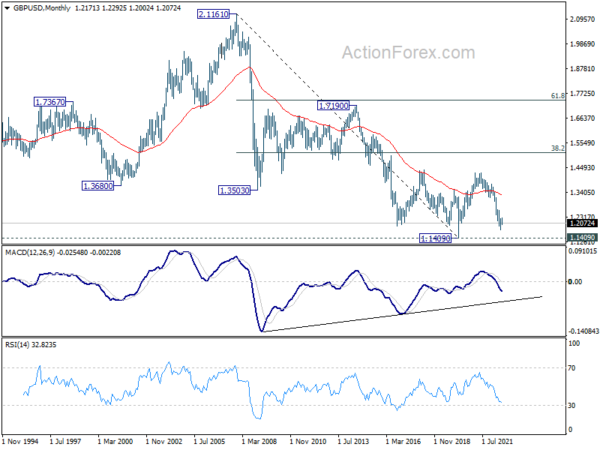

In the bigger picture, fall from 1.4248 (2018 high) could be a leg inside the pattern from 1.1409 (2020 low), or resuming the longer term down trend. Deeper decline is expected as long as 1.2666 resistance holds. Next target is 1.1409 low. However, firm break of 1.2666 will bring stronger rise back to 55 week EMA (now at 1.2925).

In the longer term picture, rebound from 1.1409 long term bottom should have completed at 1.4248 already, well ahead of 38.2% retracement of 2.1161 to 1.1409 at 1.5134. The development argues that price actions from 1.1409 are developing into a corrective pattern only. That is, long term bearishness is retained for resuming the down trend from 2.1161 (2007 high) at a later stage.