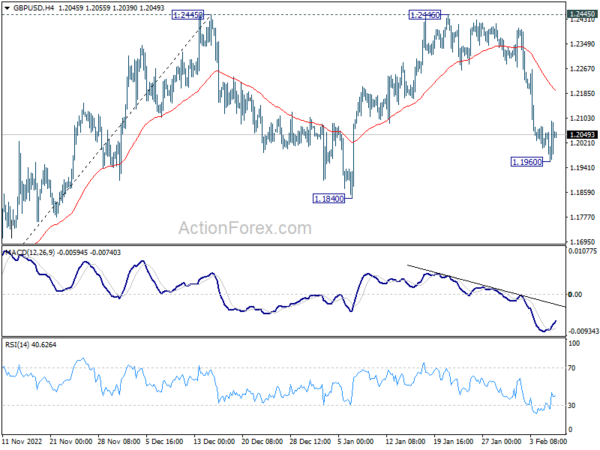

Daily Pivots: (S1) 1.1975; (P) 1.2035; (R1) 1.2109; More…

Intraday bias in GBP/USD is turned neutral with 4 hour MACD crossed above signal line. Fall from 1.2446, as the third leg of the corrective pattern from 1.2445, could still extend lower. Below 1.1960 will target 1.1840 support and possibly below. But downside should be contained by 38.2% retracement of 1.0351 to 1.2445 at 1.1645 to bring rebound. On the upside, firm break of 4 hour 55 EMA (now at 1.2192) will bring retest of 1.2445/6.

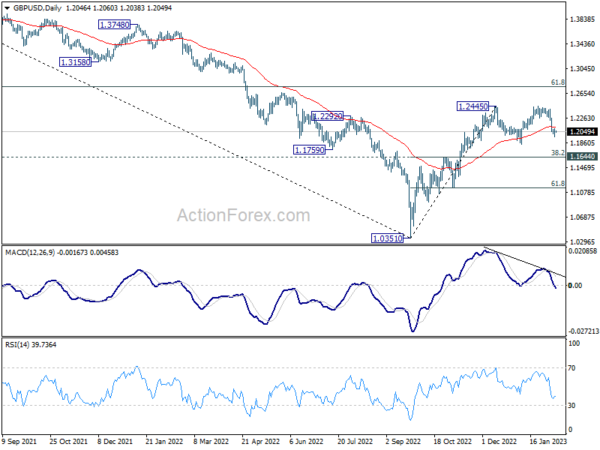

In the bigger picture, rise from 1.0351 medium term bottom is at least correcting whole down trend from 1.4248 (2021 high). Further rise is expected as long as 1.1644 resistance turned support holds. Next target is 61.8% retracement of 1.4248 to 1.0351 at 1.2759. Sustained break there will pave the way back to 1.4248.