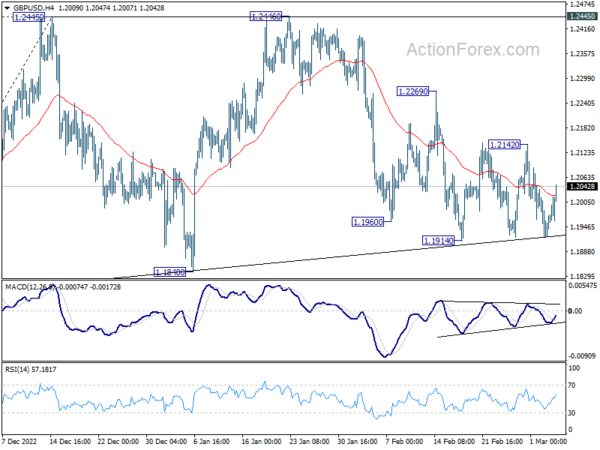

GBP/USD stayed in sideway pattern above 1.1914 last week. Initial bias remains neutral this week first. On the downside, break of 1.1914 will resume the decline from 1.2446, as the third leg of the corrective pattern from 1.2445, for 1.1840 support and possibly below. On the upside, break of 1.2142 resistance will turn bias back to the upside for further rebound to 1.2269 and above.

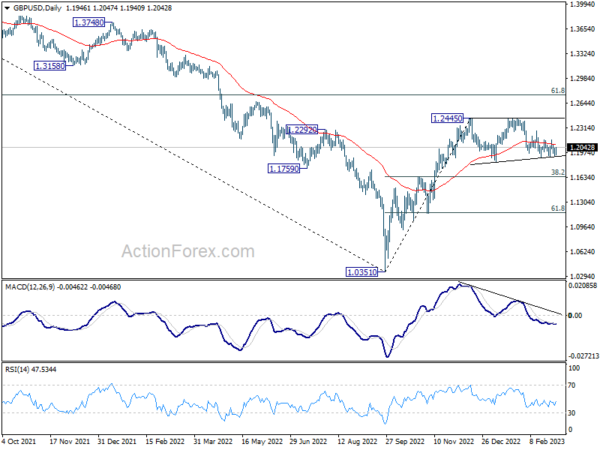

In the bigger picture, as long as 1.1840 support holds, rise from 1.0351 medium term bottom (2022 low) should still continue to 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759. However, decisive break of 1.1840 will complete a double top pattern (1.2445, 1.2446) after rejection by 55 week EMA (now at 1.2243). Deeper decline should be seen back to 38.2% retracement of 1.0351 to 1.2445 at 1.1645.

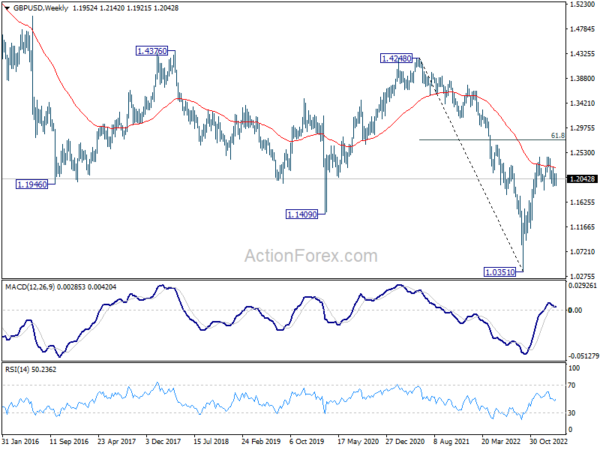

In the longer term picture, as long as 1.4248 resistance holds (2021 high), long term outlook will remain neutral at best. Down trend from 2.1161 (2007) could still resume for another low through 1.0351 at a later stage.