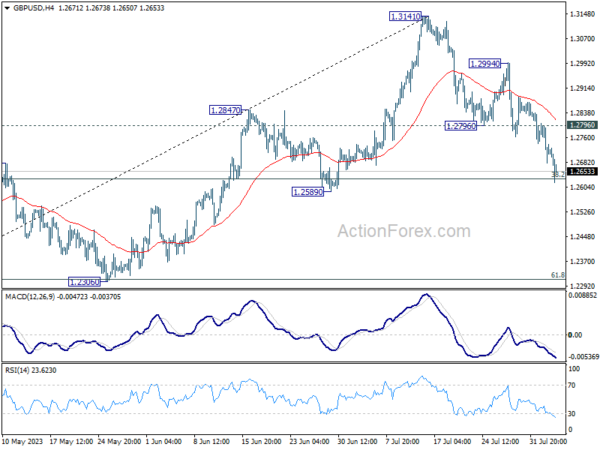

Daily Pivots: (S1) 1.2659; (P) 1.2732; (R1) 1.2784; More…

GBP/USD’s decline from 1.3141 extends to as low as 1.2618 so far today, and met 38.2% retracement of 1.1801 to 1.3141 at 1.2629 already. There is no sign of bottoming yet and intraday bias remains on the downside. Sustained trading below 1.2678 support turned resistance will argue that it’s already in a larger correction and target 1.2306 support next. Nevertheless, strong rebound from current level, followed by break of 1.2796 resistance, will retain near term bullishness and turn bias back to the upside.

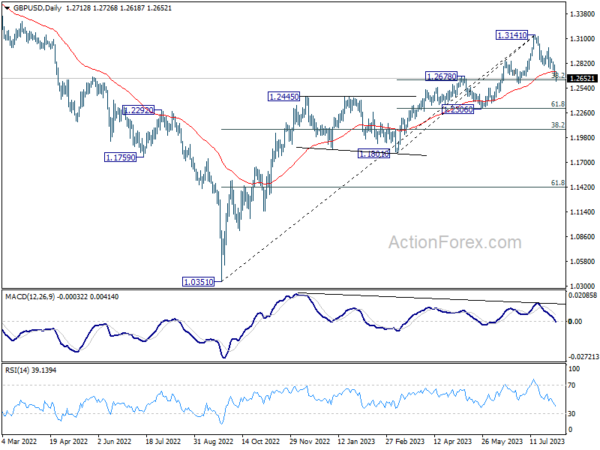

In the bigger picture, the firm break of 55 D EMA (now at 1.2723) is raising the chance of medium term topping at 1.3141. This is also supported by bearish divergence condition in D MACD. Sustained trading below 1.2678 will indicate that fall from 1.3141 is at least correcting whole up trend from 1.0351, with risk of bearish reversal. Deeper fall would be seen back to 38.2% retracement of 1.0351 to 1.3141 at 1.2075.