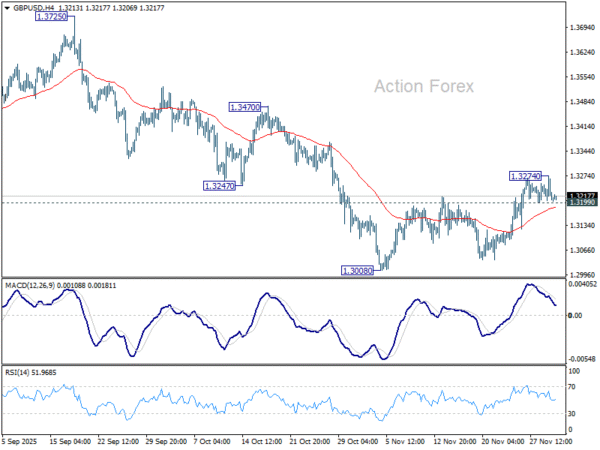

Daily Pivots: (S1) 1.3188; (P) 1.3232; (R1) 1.3257; More…

GBP/USD retreated quickly after edging higher to 1.3274 and intraday bias is turned neutral again. On the upside, sustained trading above 55 D EMA (now at 1.3265) should confirm that fall from 1.3787 has completed as a correction. Further rise should then be seen to 1.3725/3787 resistance zone. On the downside, however, firm break of 1.3199 minor support will revive near term bearishness, and bring retest of 1.3008.

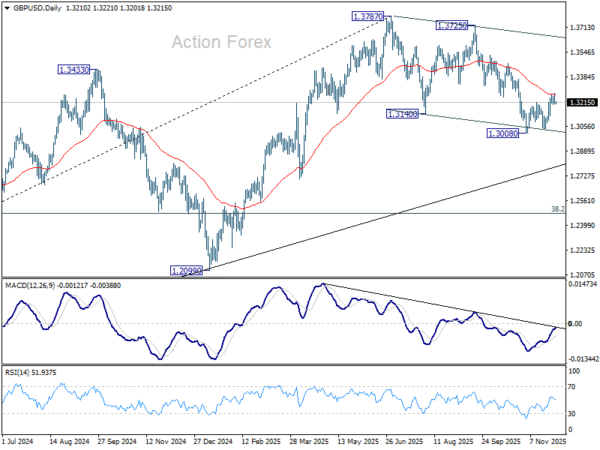

In the bigger picture, the break of 55 W EMA (now at 1.3184) is taken as the first sign that corrective rise from 1.0351 (2022 low) has completed. Decisive break of trend line support (now at 1.2760) will solidify this case and target 38.2% retracement of 1.0351 to 1.3787 at 1.2474 next. Meanwhile, in case of another rise, strong resistance should emerge below 1.4248 (2021 high) to cap upside to preserve the long term down trend.