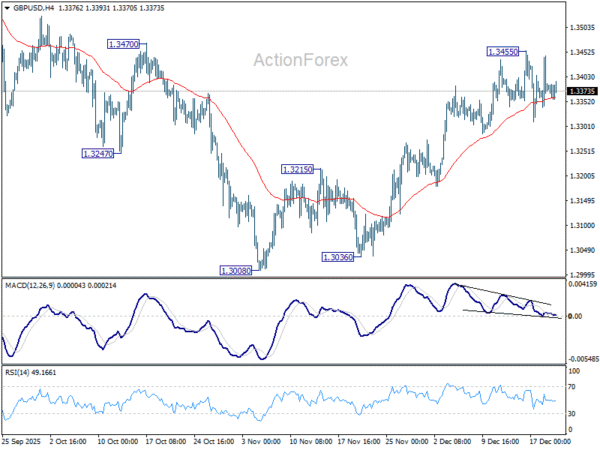

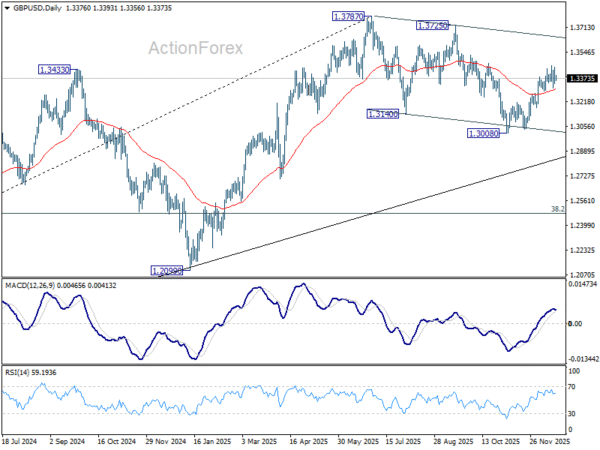

GBP/USD edged higher to 1.3455 last week but quickly retreated. Initial bias remains neutral this week first, On the upside, above 1.3455 will resume the rebound from 1.3008. Firm break of 1.3470 resistance will pave the way to retest 1.3787 high. However, sustained break of 55 D EMA (now at 1.3301) will argue that the rebound has completed. Deeper fall would be seen back to 1.3008 support to resume the whole corrective pattern from 1.3787 high.

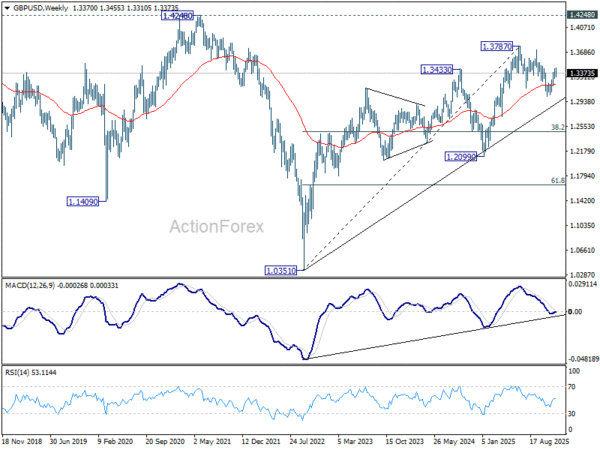

In the bigger picture, current development suggests that fall from 1.3787 is merely a corrective move, and larger rise from 1.0351 (2022 low) is still in progress. Firm break of 1.3787 will target 1.4248 (2021 high) key structural resistance. This will remain the favored case as long as target 38.2% retracement of 1.0351 to 1.3787 at 1.2474 holds, in case of another fall.

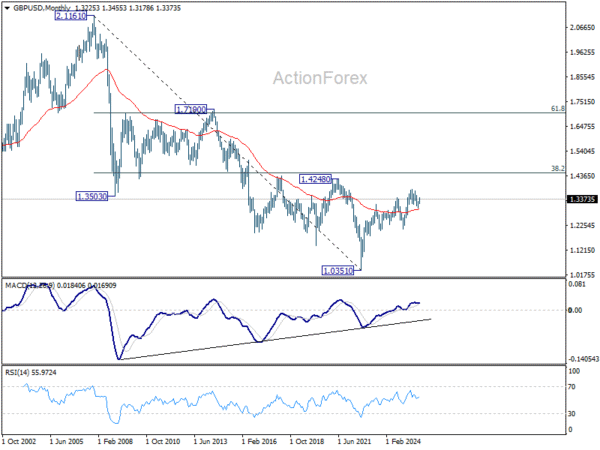

In the long term picture, as long as 1.4248/4480 resistance zone holds (38.2% retracement of 2.1161 to 1.0351 at 1.4480), the long term outlook will remain bearish. That is, price actions from 1.3051 are seen as a corrective pattern to down trend from 2.1161 (2007 high) only. Nevertheless, decisive break of 1.4248/4480 will be a strong sign of long term bullish reversal.