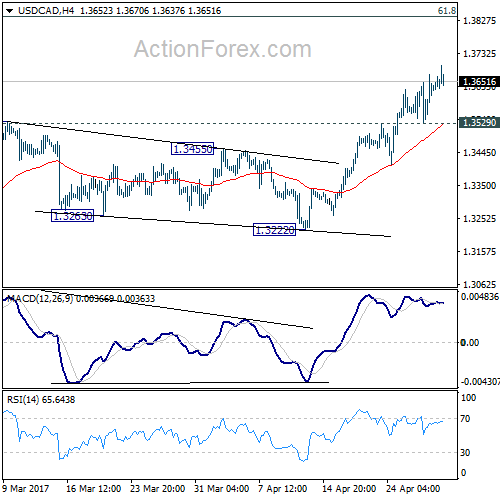

USD/CAD rose strongly to as high as 1.3693 last week. The break of 1.3598 resistance confirms resumption of medium term rise from 1.2460. Further rally would now be seen to next medium term fibonacci level at 1.3838 ahead.

Initial bias in USD/CAD remains on the upside this week. Current rise from 1.3222 should now target 1.3838 fibonacci level. Rise from 1.2460 is having a corrective structure. Hence, we’d look for topping signal above 1.3898. On the downside, below 1.3529 minor support will turn bias neutral and bring consolidation. But for now, outlook will remain bullish as long as 1.3222 support holds.

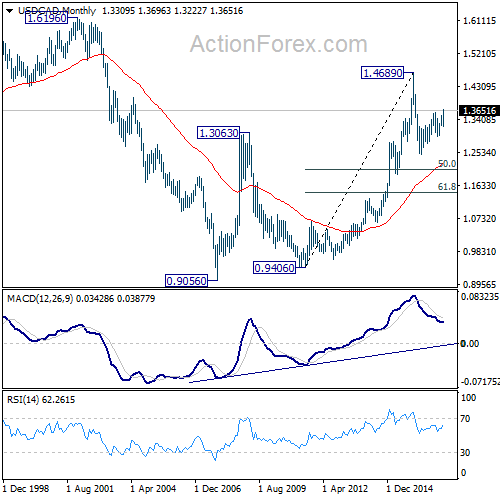

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg from 1.2460 is likely still in progress and could target 61.8% retracement of 1.4689 to 1.2460 at 1.3838. We’d look for reversal signal there to start the third leg. However, break of 1.3222 support will argue that the third leg has already started and should at least bring a retest of 1.2460 low. Meanwhile, sustained trading above 1.3838 would pave the way to retest 1.4689 high.

In the longer term picture, rise from 0.9056 (2007 low) is viewed as a long term up trend. It’s taking a breath after hitting 1.4689. But such rise expected to resume later to test 1.6196 down the road.