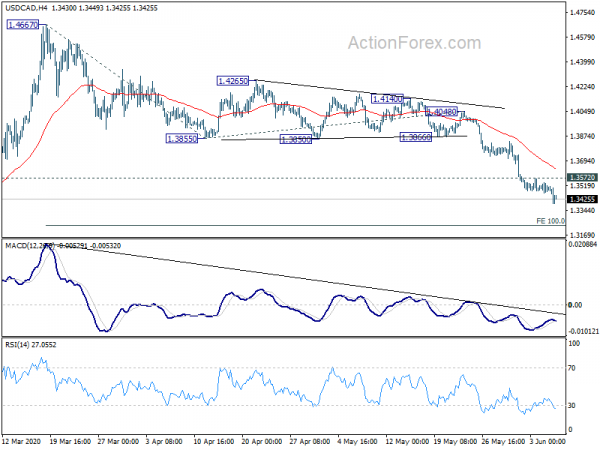

USD/CAD’s decline accelerated to as low as 1.3391 last week, without sign of bottoming. Initial bias remains on the downside this week for 100% projection of 1.4667 to 1.3855 from 1.4048 at 1.3236 next. On the upside, break of 1.3572 minor resistance will turn intraday bias neutral and bring recovery first.

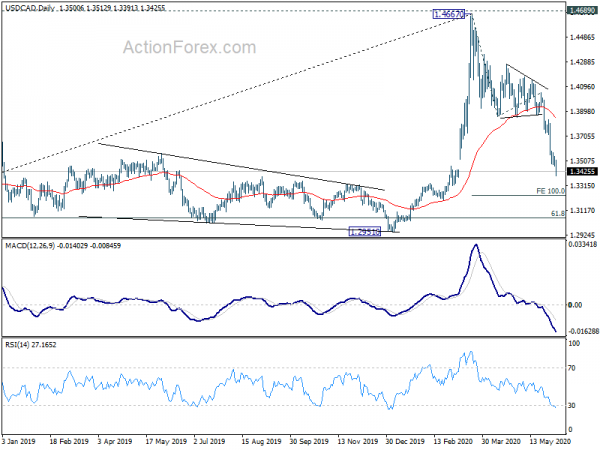

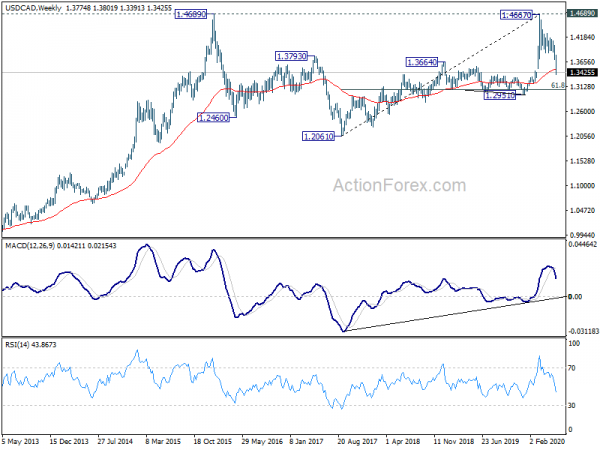

In the bigger picture, the strong break of 1.3664 resistance turned support, as well as the 55 week EMA (now at 1.3495), suggests that whole rise from 1.2061 (2017 low) has completed at 1.4667 (after failing 1.4689 (2016 high). Fall from 1.4667 could be the third leg of the corrective pattern from 1.4689. Deeper fall is expected to 61.8% retracement at 1.3056 and possibly below. This will now remain the favored case as long as 1.3855 support turned resistance holds.

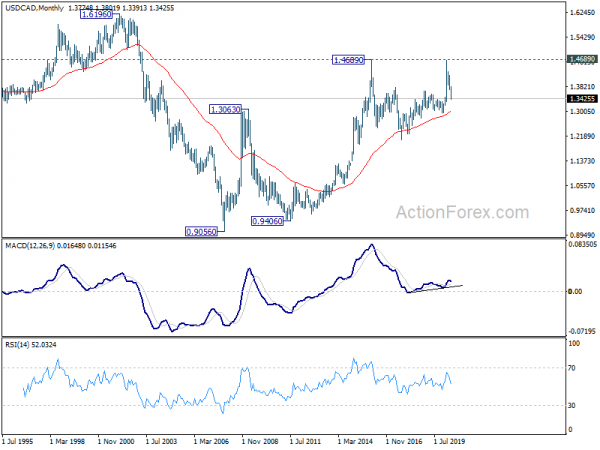

In the longer term picture, the bullish case of resuming the up trend from 0.9506 (2007 low) is delayed. Consolidation from 1.4689 is extending for another medium term fall. As long as 1.2061 support holds, such up trend should still resume through 1.4689 at a later stage.