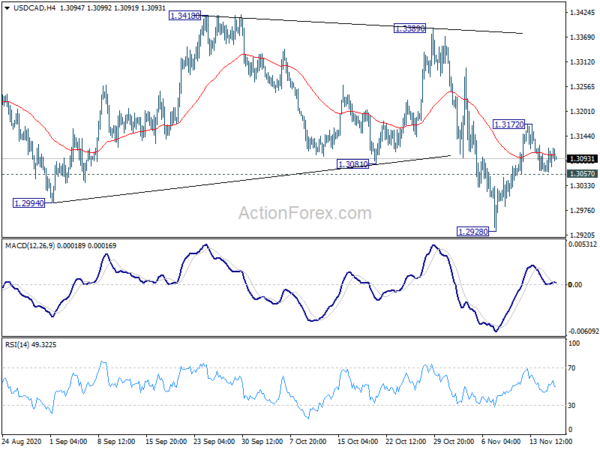

Daily Pivots: (S1) 1.3071; (P) 1.3094; (R1) 1.3123; More….

Intraday bias in USD/CAD is staying neutral for the moment. Another rise could be seen to 55 day EMA (now at 1.3194) and above. Still, near term outlook remains bearish as long as 1.3389 resistance holds, and down trend resumption is expected. On the downside, break of 1.3057 minor support will turn bias to the downside for retesting 1.2928 low.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Rejection by 55 week EMA is keeping outlook bearish. Sustained break of 61.8% retracement of 1.2061 to 1.4667 at 1.3056 will target a test on 1.2061 (2017 low). But we’d expect loss of downside momentum as it approaches this key support. On the upside, firm break of 1.3389 resistance is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.