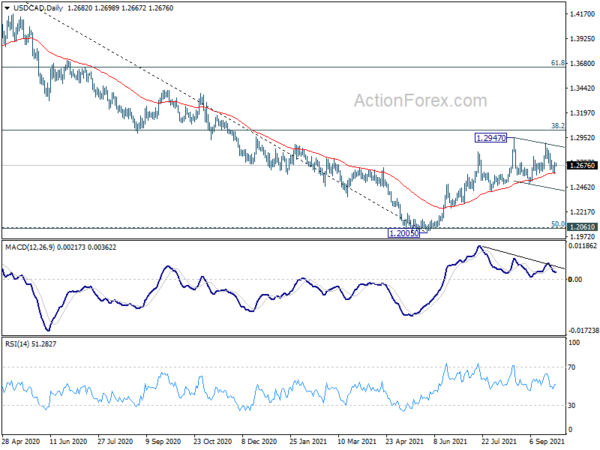

Daily Pivots: (S1) 1.2614; (P) 1.2661; (R1) 1.2727; More…

Intraday bias in USD/CAD is turned neutral with current recovery. On the downside, break of 1.2592 will resume the fall from 1.2891, as the third leg of the pattern from 1.2947, to 1.2492 support and possibly below. On the upside, above 1.2729 minor resistance will turn bias back to the upside for 1.2891/2947 resistance zone instead. Overall, with 1.2421 support intact, rise from 1.2005 should still be in progress for another rally through 1.2947 at a later stage.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). It should have completed after hitting 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048. Sustained break of 38.2% retracement of 1.4667 to 1.2005 at 1.3022 will pave the way to 61.8% retracement at 1.3650 and above. Overall, medium term outlook remains neutral at worst with 1.2048/61 support zone intact.