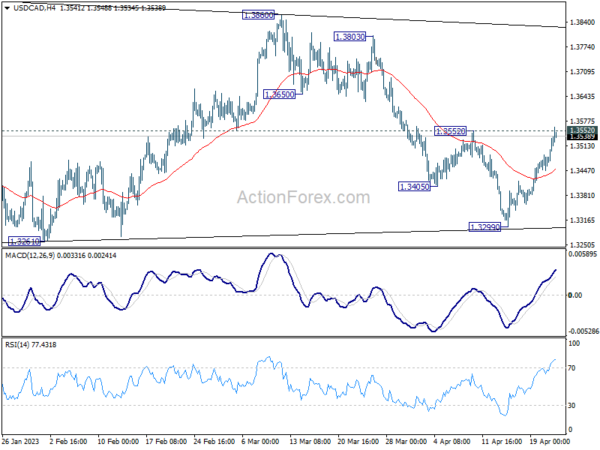

USD/CAD’s rebound from 1.3299 extended higher last week. Immediate focus is now on 1.3352 resistance. As noted before, price actions from 1.3976 are seen as a corrective pattern with fall from 1.3860 as the third leg. Decisive break of 1.3552 will argue that such corrective pattern has completed. Further rally should then be seen back to 1.3860/3976 resistance zone.

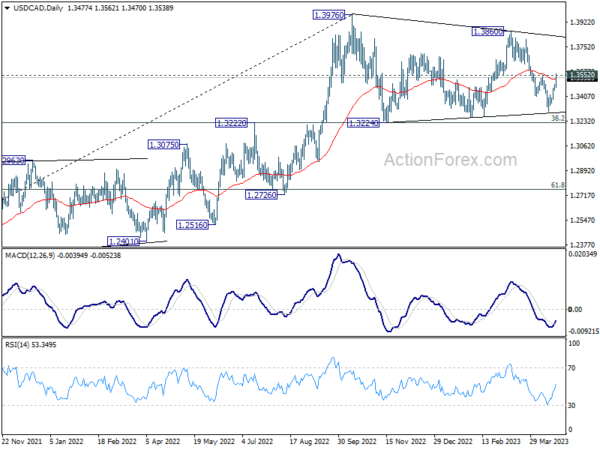

In the bigger picture, the up trend from 1.2005 (2021 low) is still in progress. Break of 1.3976 will confirm resumption and target 61.8% projection of 1.2401 to 1.3976 from 1.3261 at 1.4234. Firm break there will pave the way to long term resistance zone at 1.4667/89 (2016, 2020 highs). On the downside, sustained break of 55 W EMA (now at 1.3302) is needed to confirm medium term topping. Otherwise, outlook will remain bullish even in case of deep pull back.

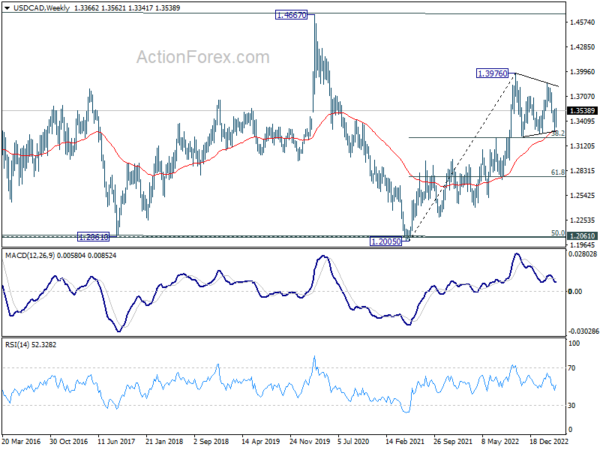

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern only, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as 55 M EMA (now at 1.3012) holds.