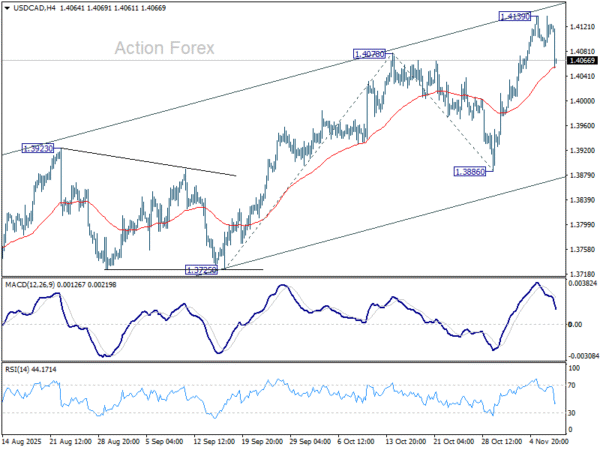

Daily Pivots: (S1) 1.4091; (P) 1.4116; (R1) 1.4141; More…

USD/CAD dips notably in early US session but stays above 55 4H EMA (now at 1.4055) so far. Intraday bias remains neutral first. On the upside break of 1.4139 will resume larger rally from 1.3538 to 100% projection of 1.3725 to 1.4078 from 1.3886 at 1.4239. However, sustained break of 55 4H EMA (now at 1.4052) will bring deeper fall back to 1.3886 support instead.

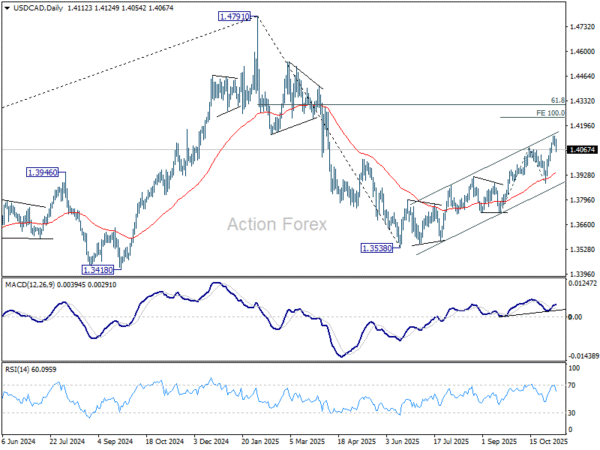

In the bigger picture, price actions from 1.4791 medium term top is likely just unfolding as a correction to up trend from 1.2005 (2021 low). Based on current momentum, rise from 1.3538 is the second leg, and a third leg should follow before up trend resumption. That is, range trading is set to extend for the medium term. For now, this will remain the favored case as long as 1.3886 support holds. However, firm break of 1.3886 will revive the case that fall from 1.4791 is indeed a larger scale correction.