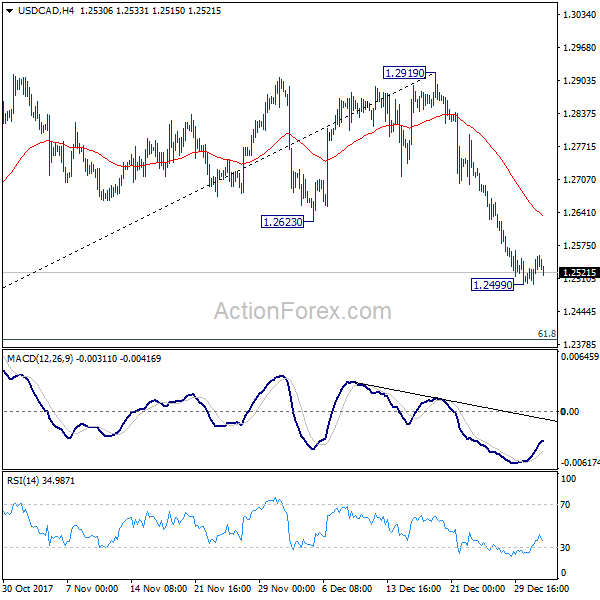

Daily Pivots: (S1) 1.2504; (P) 1.2529; (R1) 1.2559; More….

A temporary low is in place at 1.2499 in USD/CAD and intraday bias is turned neutral first. As long as 4 hour 55 EMA (now at 1.2363) holds, deeper decline is expected. Below 1.2499 will extend the fall from 1.2919 to 61.8% retracement of 1.2061 to 1.2919 at 1.2389 or possibly below. Nonetheless, sustained break of 4 hour 55 EMA will argue that the decline is completed. In such case, intraday bias will be turned back to the upside for retesting 1.2919 instead.

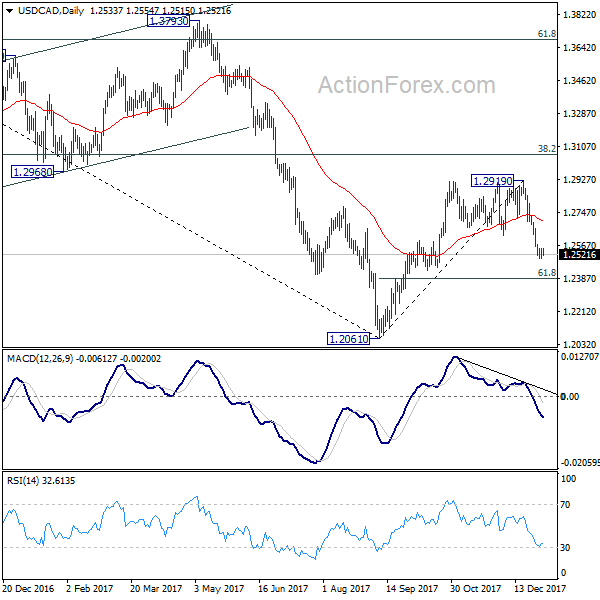

In the bigger picture, we’re still favoring the case that USD/CAD has defended 50% retracement of 0.9406 (2011 low) to 1.4689 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. With that in mind, fall from 1.2919 is viewed as a correction. Hence, we’re not anticipating a break of 1.2061 low. In the long run, USD/CAD should have another medium term rise to take on 38.2% retracement of 1.4689 to 1.2061 at 1.3065.