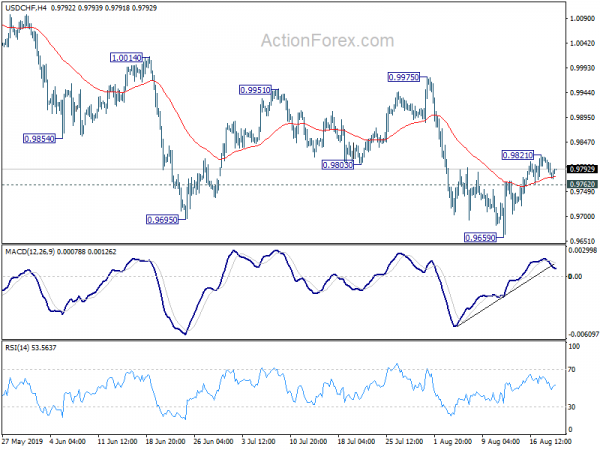

Daily Pivots: (S1) 0.9763; (P) 0.9790; (R1) 0.9806; More…

A temporary topis formed at 0.9821 in USD/CHF and intraday bias is turned neutral first. On the downside, break of 0.9762 will suggest completion of recovery from 0.9659. Intraday bias will be turned back to the downside for retesting 0.9659 first. On the upside, above 0.9821 will extend the rebound to 55 day EMA (now at 0.9856). Sustained break will target 0.9975 resistance.

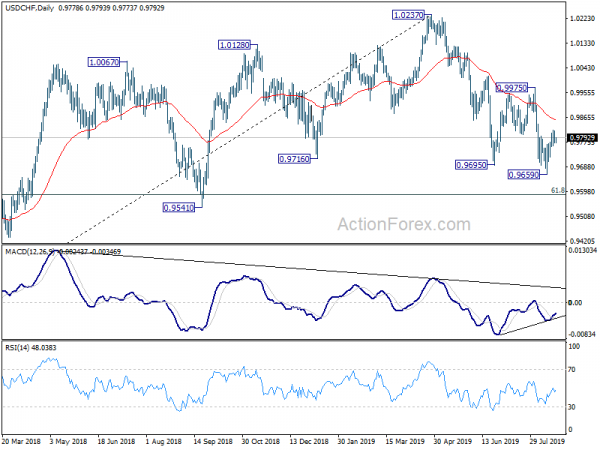

In the bigger picture, up trend from 0.9186 (2018 low) should have completed at 1.0237 already. Deeper decline would be seen to 61.8% retracement of 0.9186 to 1.0237 at 0.9587 and below. For now, USD/CHF is seen as in long term range pattern between 0.9186 and 1.0342. Hence, we’d pay attention to bottoming signal below 0.9587. Nevertheless, break of 0.9975 resistance is needed to indicate completion of the decline from 1.0237. Otherwise, risk will stay on the downside.