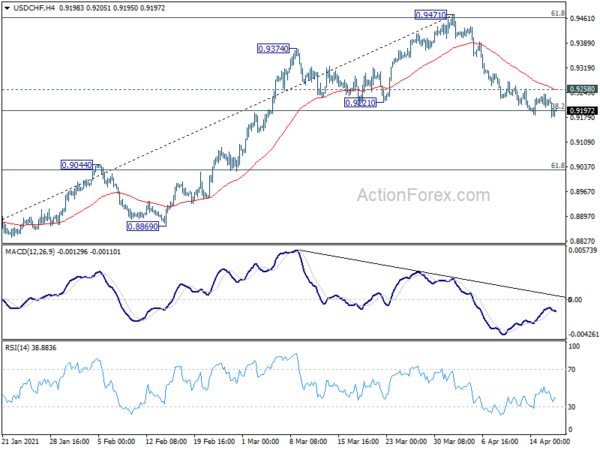

USD/CHF extended the decline from 0.9471 last week but struggled to take out 38.2% retracement of 0.8756 to 0.9471 at 0.9198 decisively. Initial bias remains neutral this week first. On the downside, sustained break of 0.9198 will extend the decline to 61.8% retracement at 0.9029. On the upside, break of 0.9258 minor resistance will argue that corrective pull back from 0.9471 has completed. Intraday bias will be turned back to the upside for retesting this high.

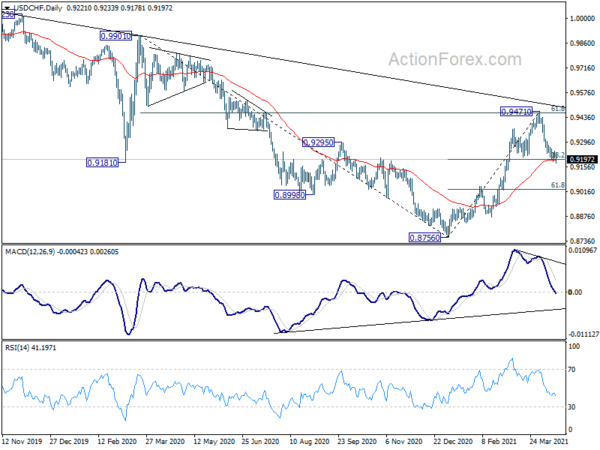

In the bigger picture, fall from 1.0237 should have completed at 0.8756, on bullish convergence condition in daily and weekly MACD. Current rally from 0.8756 should target 0.9901 resistance first. Break there will target 1.0237/0342 resistance zone in the medium term. However, sustained trading below 55 day EMA (now at 0.9192) will revive medium term bearishness for down trend extension through 0.8756 at a later stage.

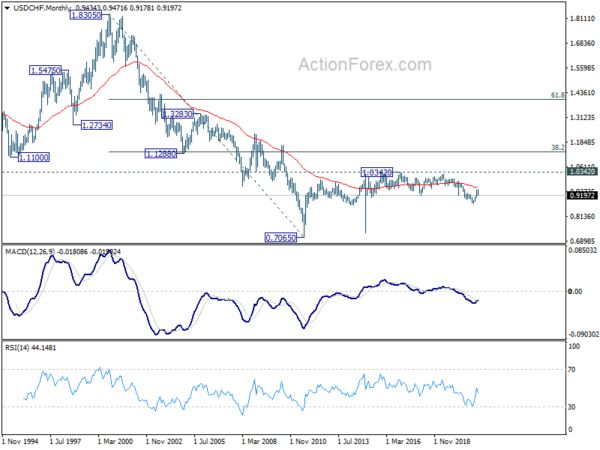

In the long term picture, price actions from 0.7065 (2011 low) are currently seen as developing into a long term corrective pattern, at least until a firm break of 1.0342 resistance.