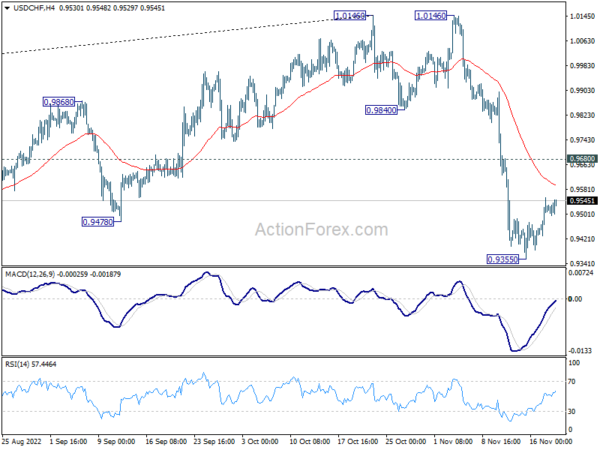

USD/CHF edged lower to 0.9355 but recovered since then. Initial bias remains neutral this week for consolidations first. But further decline is expected as long as 0.9680 resistance holds. Break of 0.9355 will resume the fall from 1.0146 to 0.9287 fibonacci level.

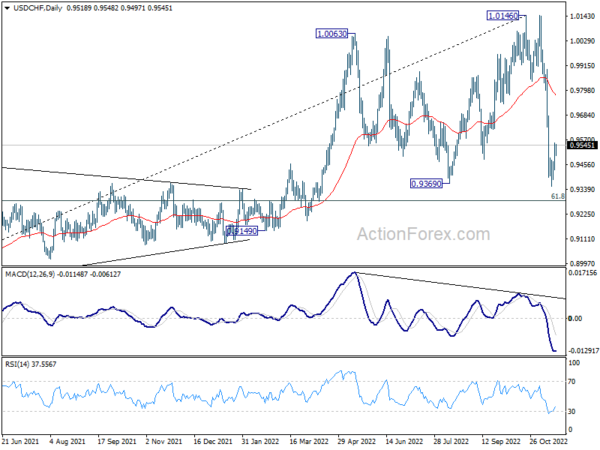

In the bigger picture, rise from 0.8756 (2021 low) has completed at 1.0146, well ahead of 1.0342 long term resistance (2016 high). Based on current downside momentum, fall from 1.0146 might be a medium term down trend itself. Break of 61.8% retracement of 0.8756 to 1.0146 at 0.9287 will pave the way to 0.8756. In any case, risk will stay on the downside as long as 55 day EMA (now at 0.9775) holds.

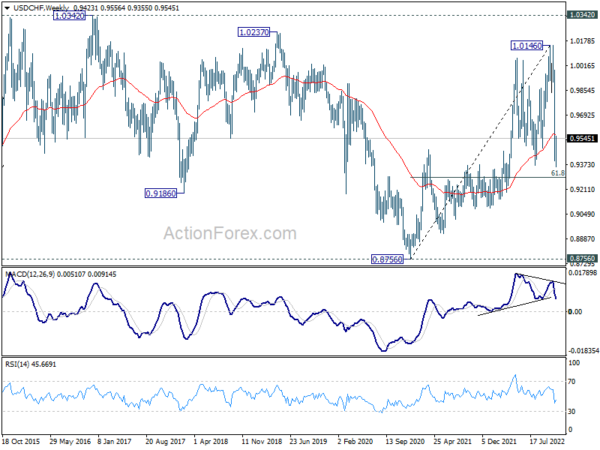

In the long term picture, long term sideway pattern from 1.0342 (2016 high) is extending and it’s probably in another medium term down leg. Downside will likely be contained by 0.8756 support in case of deeper fall. Overall, range trading should continue until further development.