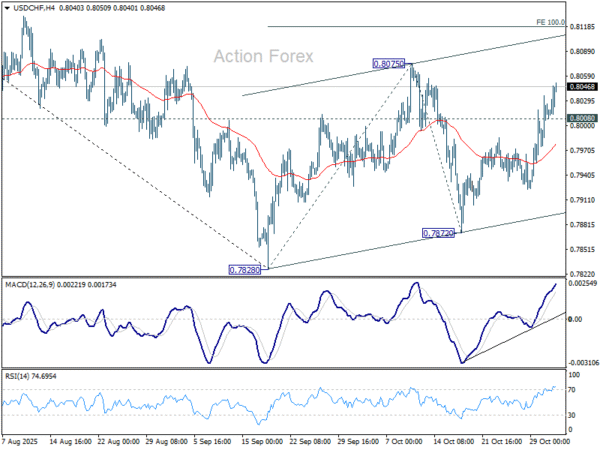

USD/CHF’s extended rebound last week suggests that corrective pattern from 0.7828 is not complete. Instead, it’s now extending with a third leg. Initial bias stays on the upside this week for 0.8075 resistance first. Break there will target 100% projection of 0.7828 to 0.8075 from 0.7872 at 0.8119. On the downside, below 0.8008 minor support will turn intraday bias neutral.

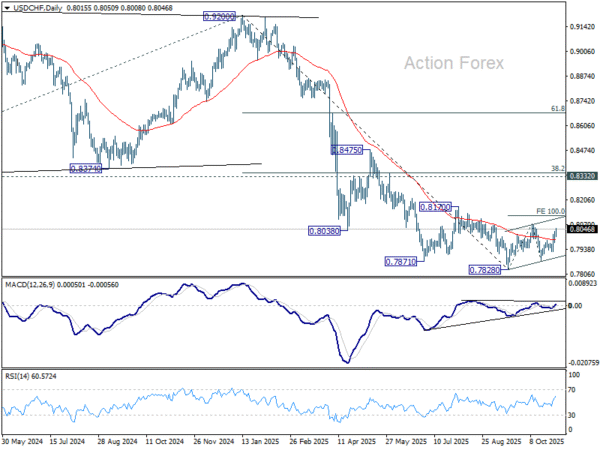

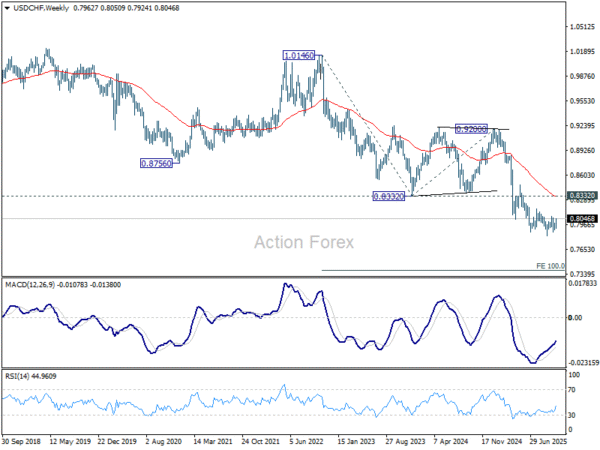

In the bigger picture, long term down trend from 1.0342 (2017 high) is still in progress. Next target is 100% projection of 1.0146 (2022 high) to 0.8332 from 0.9200 at 0.7382. In any case, outlook will stay bearish as long as 0.8332 support turned resistance holds (2023 low).

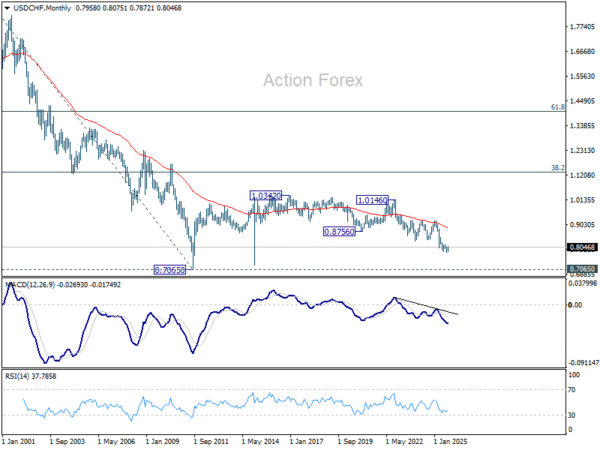

In the long term picture, price action from 0.7065 (2011 low) are seen as a corrective pattern to the multi-decade down trend from 1.8305 (2000 high). It’s uncertain if the fall from 1.0342 is the second leg of the pattern, or resumption of the downtrend. But in either case, outlook will stay bearish as long as 0.8756 support turned resistance holds (2021 low). Retest of 0.7065 should be seen next.