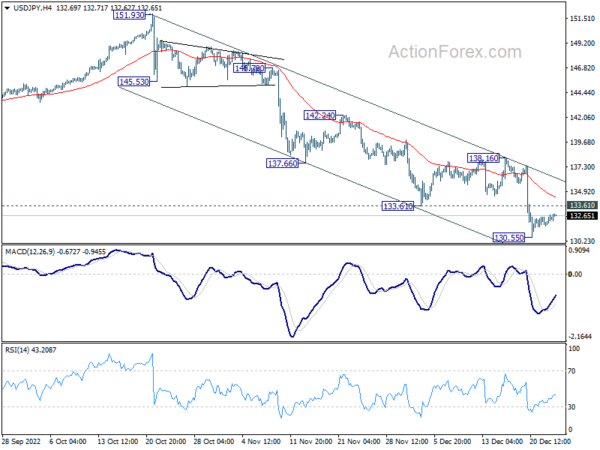

Daily Pivots: (S1) 131.78; (P) 132.24; (R1) 132.85; More…

USD/JPY is still bounded in tight range above 130.55 and intraday bias remains neutral. Immediate focus remains on 55 week EMA (now at 131.76). Decisive break there will pave the way to next fibonacci level at 121.43. On the upside, above 133.61 support turned resistance will turn intraday bias back to the upside for 138.16 resistance.

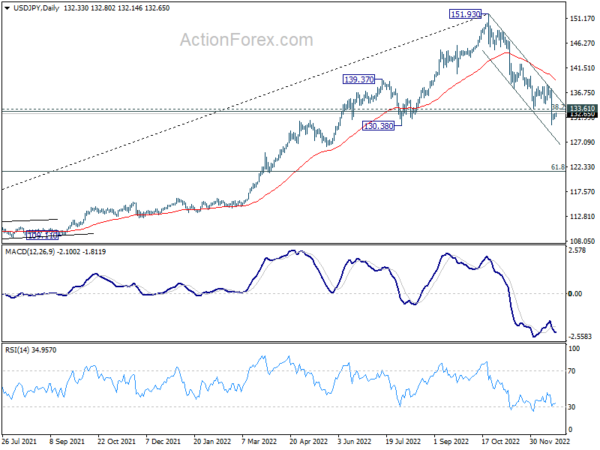

In the bigger picture, price actions from 151.93 medium term could be just a corrective pattern to up trend from 102.58 (2021 low). Strong support from 38.2% retracement of 102.58 to 151.93 at 133.07 and 55 week EMA (now at 131.76) will set the range for such corrective pattern. However, sustained break of 55 week EMA will pave the way to 61.8% retracement at 121.43.