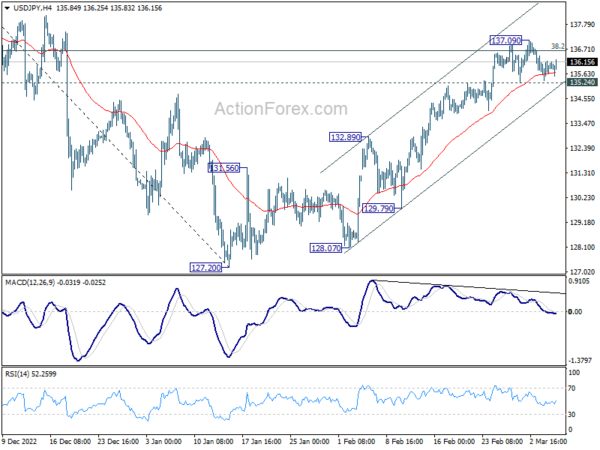

Daily Pivots: (S1) 135.47; (P) 135.83; (R1) 136.29; More…

Intraday bias in USD/JPY remains neutral and outlook is unchanged. On the downside, break of 135.24 support will indicate short term topping, after rejection by 38.2% retracement of 151.93 to 127.20 at 136.64. Intraday bias will be turned back to the downside for 55 day EMA (now at 134.05) first. Sustained break of 55 day EMA will indicate that whole rebound from 127.20 has completed. On the upside, however, sustained break of 136.64 will indicate that fall from 151.93 has completed, and bring further rally to 61.8% retracement at 142.48.

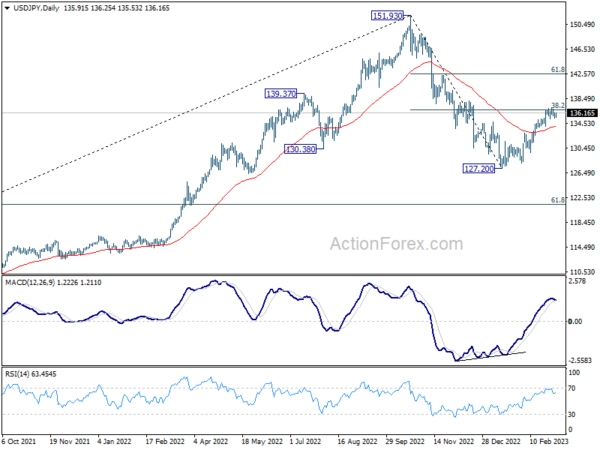

In the bigger picture, focus remains on 38.2% retracement of 151.93 to 127.20 at 136.64. Sustained break there will indicate that price actions from 151.93 medium term are merely a corrective pattern. Such development will maintain long term bullishness. Rejection by 136.64 will, on the other hand, extend the fall from 151.93 to 61.8% retracement of 102.58 to 151.93 at 121.43 at a later stage.