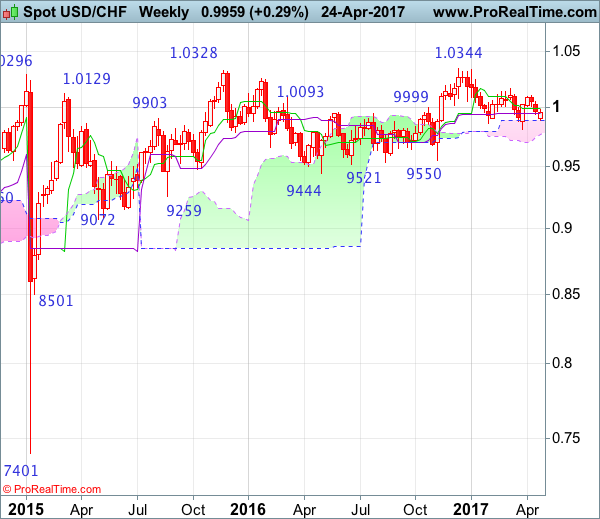

Weekly

• Last Candlesticks pattern: Doji

• Time of formation: 26 Sep 2016

• Trend bias: Sideways

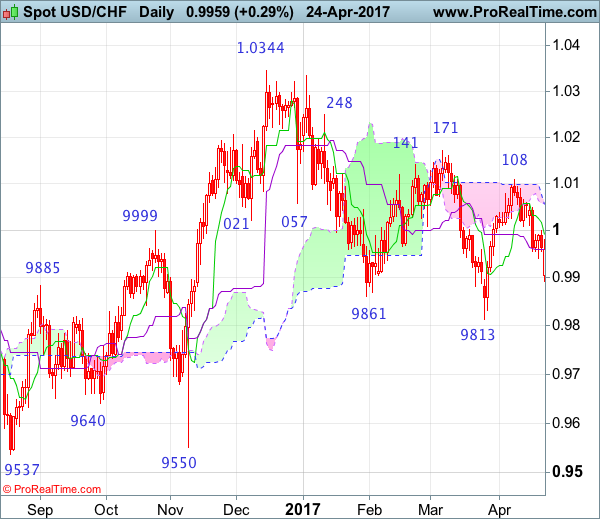

Daily

• Last Candlesticks pattern: Shooting star

• Time of formation: 25 Oct 2016

• Trend bias: Near term up

USD/CHF – 0.9978

Although the greenback opened lower yesterday and fell to as low as 0.9893, the subsequent rebound suggests consolidation above this level would be seen and as long as this support holds, prospect of another bounce 1.0000-08 resistance remains, a daily close above there would signal low is formed, then gain to 1.0025-30 (61.8% Fibonacci retracement of 1.0108-0.9893) would be seen, however, break of 1.0067 is needed to retain bullishness and signal the retreat from 1.0108 has ended, bring retest of this level later, break there would extend the rebound from 0.9813 towards key resistance at 1.0171. Looking ahead, only a sustained breach above this level would add credence to our view that the erratic decline from 1.0344 top has ended at 0.9813, bring further rise to 1.0200-10, then 1.0250 but price should falter well below said resistance at 1.0344 (2016 high).

On the downside, below said support at 0.9893 would abort and signal the rebound from 0.9813 has ended instead, bring another fall to this level. Looking ahead, only a drop below said support at 0.9813 would revive bearishness and signal the decline from 1.0344 top has resumed instead and extend further fall to 0.9735-40 (76.4% retracement of 0.9550-1.0344) and later towards 0.9700 but reckon 0.9650-60 would hold.

Recommendation: Hold long entered at 0.9990 for 1.0190 with stop below 0.9890.

On the weekly chart, although dollar opened lower yesterday, still reckon the upper Kumo (now at 0.9886) would limit downside and bring rebound later to the Tenkan-Sen (now at 0.9992) but break of resistance at 1.0067 is needed to retain bullishness and signal the retreat from 1.0108 has ended, bring retest of this level. A break above 1.0108 would extend the rebound from 0.9813 to resistance at 1.0171, however, a weekly close above this level is needed to confirm the fall from 1.0344 top has ended at 0.9813, bring further subsequent rise towards key resistance at 1.0248. A sustained breach above this level would signal early upmove has possibly resumed, bring test of 1.0335-44 resistance area, above there would provide confirmation and headway to 1.0400-10 and later 1.0500 would follow.

On the downside, below the upper Kumo (now at 0.9886) would defer but only break of indicated support at 0.9813 would abort and signal the erratic fall from 1.0344 top is still in progress, bring further decline for retracement of early upmove to 0.9735-40, then 0.9700 but reckon downside would be limited to 0.9640-50 and price should stay well above support at 0.9550.