The US dollar started the month by rising against its global peers. The rise came as trade worries mounted. On Friday, it was announced that the North American Free Trade Agreement (NAFTA) talks would extend beyond the deadline. Traders are pessimistic about the NAFTA deal because of the incendiary comments by President Trump about Canada. The leaked comments showed the president saying that he was prepared to move on without Canada. He also said that if the deal was to happen, it will be totally on US terms. These statements were a setback to the ongoing talks and the optimism they had built.

The USD rose by 25 basis points against the Australian dollar. This happened after disappointing retail sales from Australia. Data showed that Australian customers held back spending in July, with sales remaining flat during the month. This was the weakest growth since March this year and was below the estimated 0.3% gain. The main contributors to the lagging retail sales were clothing and footwear which declined by 2%. The declines were offset by an increase in food sales. In the second quarter, business inventories rose by 0.6%, which was better than the expected 0.3% while the company gross operating profits rose by 2.0%, which was better than the expected 1.4%. Traders will watch out for the AUD/USD pair as the RBA releases its interest rates decision tomorrow.

The New Zealand dollar fell against the dollar after weak data on trade. The New Zealand bureau of statistics released trade data that was weaker than expected. In the second quarter, the export prices rose by 2.4%, which was lower than the expected 3.0%. This data measures the average price of the country’s exports. The import price index rose by 1.7%, which was weaker than the expected 2.0%. In total, the terms of trade in the quarter was 0.6%, lower than the expected 1.0% gain. The terms of trade data measure the ratio of an export to the price of an import per commodity.

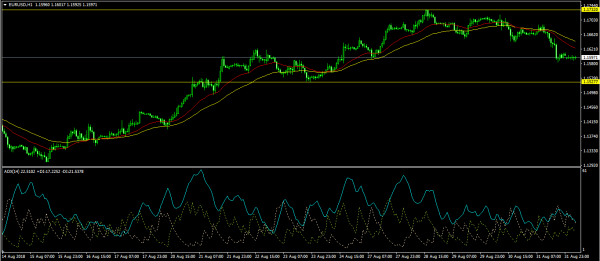

EUR/USD

The EUR/USD pair fell slightly during the Asian session to an intraday low of 1.1597. This will be the pair to watch this week as the US releases employment data for August and as the EU releases the final revision of the second quarter GDP numbers. The current price is below the 25 and 50-day EMA and is at an important support level. The ADX is at 22, which is an indication that the downward trend is weaker. If the pair continues the downward movement, traders should watch out for the 1.1530 support.

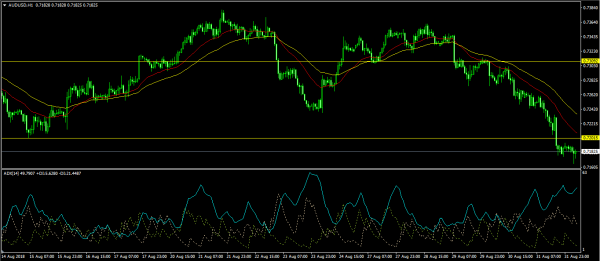

AUD/USD

The AUD/USD pair fell to an intraday low of 0.7165. As it dropped, it crossed the important support of 0.7200. The current price is below the 25 and 50-day EMA with the ADX at 62. This is an indication that the downward trend could continue as traders wait for the monetary policy statement from the RBA. This was the lowest level since January this year. If it continues to fall, the pair will likely test the 0.6800 support.

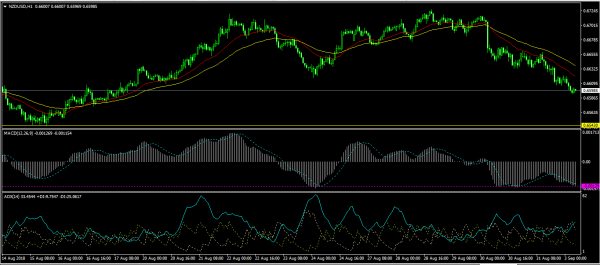

NZD/USD

The NZD/USD pair fell to an intraday low of 0.6593. This was the lowest level since mid-August. It is now trading at 0.6597, with the downward trend being a strong one as confirmed by the Average Directional Index (ADX). The MACD is in the lowest level since Monday last week. Lacking an important support, the pair is likely to continue moving lower.